Cashless Gaming Implementation

A Call to Action for Innovation to Drive Growth, Improve the Player Experience, and Increase Security

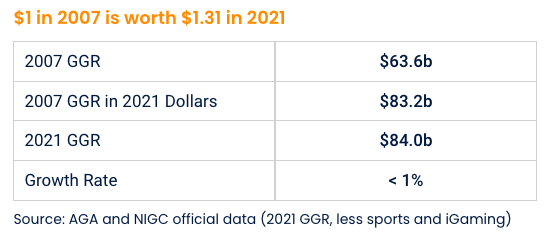

The lack of new technology adoption on the casino floor and the gaming industry’s reliance on decades old technologies have significantly hampered industry-wide revenue growth. In fact, on an inflation adjusted basis, aggregate slot and table revenue at commercial and tribal casinos in the United States was flat in 2021 compared to 2007, despite expansion into new jurisdictions and the addition of many new casinos.

Using 2007 as a base year for this comparison is important because that year’s launch of the iPhone led to a cycle of accelerating technology innovation that transformed the way entire industries conduct business. Industries that have embraced new technology continue to flourish while those that have lagged are, at best, seeing a plateau in revenue.

The last impactful introduction of a new, modern technology for the casino industry was the advent of TITO (ticket-in-ticket-out) in the early 2000s. TITO provided a seamless user experience while offering operators quantifiable cost savings. Now, over 20 years since the introduction of TITO, it is time to bring to the casino floor new modern technologies that can replicate the success of TITO and help drive industry revenue growth, lower costs and enhance the player experience by catering to modern consumer preferences.

Given evolving customer preferences and the benefit of lower operating expenses, the implementation of a cashless casino environment is one of the gaming industry’s biggest opportunities. As casino operators evaluate cashless technology options, the two most important factors in this review are the player experience and the security of customer deposits. Cashless isn’t the wave of the future because it is already here. As such, technology providers must meet the needs of casino operators and the demands of their players by offering modern, flexible cashless gaming technologies that address the critical security and experience factors.

Unfortunately, evaluations of cashless gaming solutions are occurring in an environment where casino systems technology has not evolved for more than 20 years while nearly every other industry has quickly adapted.

The Right Modern Technology for Adopting Cashless Gaming on Casinos Today and for the Future

Casino guests opting to take advantage of a cashless environment must feel safe with their decision to deposit money, move it around the casino, and access it once they leave the property.

Large legacy casino systems suppliers have responded to the resounding consumer preference for cashless solutions by resurrecting legacy technology built around a Cashless Wagering Account (“CWA”), as evidenced by the products offered by IGT, Light & Wonder, Aristocrat and Konami. Each of these companies offer solutions that recycle decades-old CWA architecture. As reviewed below, this old CWA technology brings with it significant limitations that create critical issues, particularly as cashless volumes increase. Furthermore, the promotion of CWA-driven legacy technologies by some of the industry’s leading equipment suppliers represents another downside for casino operators as they require the casino to assume liability for all player deposits. To this end, casino operators offering online sports betting and/or iGaming are already concerned with having to secure sports wagering deposits and carry these deposits on their balance sheet and are looking for new ways to structure around this exposure.

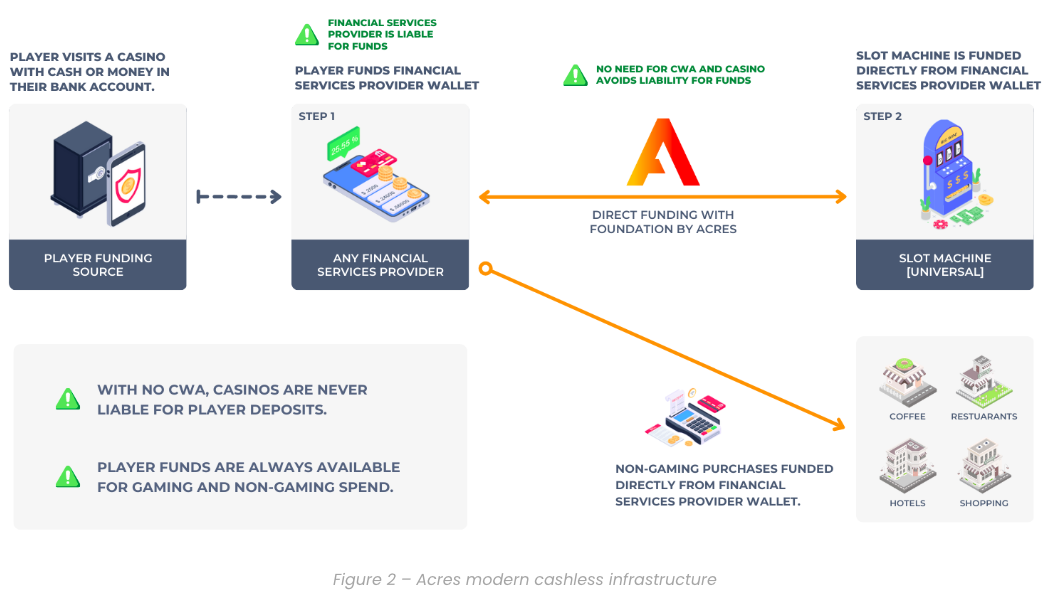

The optimal cashless solution eliminates the CWA altogether. Acres’ Cashless Casino solution is a modern technology solution that effectively mitigates risk, operates more quickly, is more secure, and offers a more intuitive player experience. Importantly for casino operators, this cashless solution allows all player deposits to remain in the custody of either the financial services provider or the player at all times. Acres’ Cashless Casino enables a modern open-loop payment system: player deposits are sent to the game directly from the financial services provider’s custody and when a cash-out occurs, funds are instantly returned to the care of the financial services provider. This provides operators with an incredibly valuable benefit: they never need to secure player deposits.

Cashless Wagering Accounts Offered by Legacy Suppliers Carry Significant Risks

CWAs are a closed loop payment system feature from a bygone era first designed into the Acres Advantage (now called IGT Advantage) system in 1996. At that time, and until recently, the only prevalent “cashless” funding option for customers was using this CWA by visiting the cage to deposit cash into their account. Once leaving the cage, the player would take their loyalty card to the slot machine to access their funds.

Using a closed loop payment system means casinos provide players access solely to internal funding systems. While this was logical approach in the late 1990s and early 2000s, more than 25 years later this same technology is extremely outdated and irrelevant given the open loop technology environment that today is powering the vast majority of cashless transactions that consumers now favor, given they regularly access funds from a variety of external sources such as bank accounts or payment cards. Legacy providers’ reliance on the outdated CWA underscores a troubling fact: these providers have almost completely ignored development in their systems businesses for over 20 years.

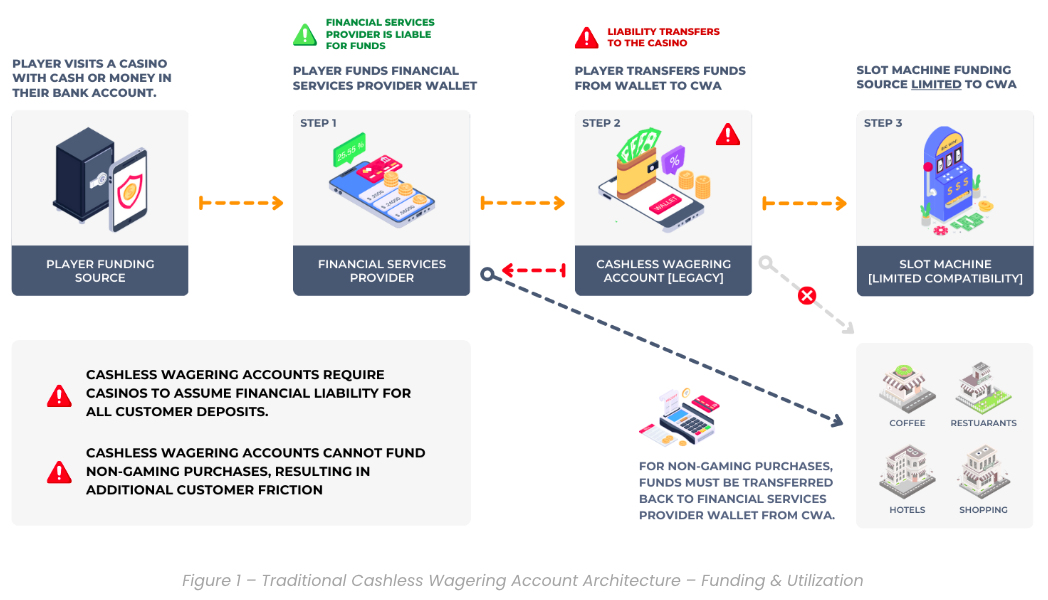

In an attempt to address the limitations of the CWA technology architecture in the IGT, Light & Wonder, Aristocrat and Konami cashless systems, these providers have modified their solutions with an added step to enable the acceptance of transfers from external financial services providers. However, as detailed below, casinos implementing these systems are left with a clunky open loop + closed loop process that adds steps for the consumer and impairs their experience by limiting the use of CWA funds to gaming only. In addition, this hybrid approach continues to bring significant risks to the operator.

CWA Puts Player Deposit Liability in the Hands of Operators

In the CWA cashless system, once a CWA is funded, the casino becomes the custodian of player funds, making it a fiduciary responsible for all customer funds, including fraud and disputes. Additionally, in this scenario, the casino must carry all deposits on its balance sheet.

In an era of profligate hacking, phishing and other criminal schemes, the deployment of CWA architecture in the casino enterprise introduces a series of unnecessary risks to the operator’s day-to-day business.

In the diagram above, the operator’s CWA maintained for the patron becomes the custodian of patron funds on deposit. As a result, the operator acts as a bank for the patron while it is in possession of those funds. This includes fiduciary and security obligations owed to the patron, as well as carrying these liabilities on the Operator’s balance sheets.

Let’s use the following example to demonstrate the risks CWA technology cashless solutions bring to the casino operator:

If casinos were responsible for limiting possession of TITO tickets to their rightful owners, they would then have to reimburse players who report a lost or stolen TITO ticket. Had casinos been required to pay the value of lost or stolen tickets from the outset of TITO, the technology likely would never have realized the near universal adoption it has today.

This is the exact scenario proposed by IGT, Light & Wonder, Aristocrat and Konami in their efforts to deploy CWA-based cashless gaming systems.

By implementing a CWA cashless architecture, a casino operator incurs significant risk and liability without requisite benefits to themselves OR the player.

The 2-Step Wallet: a Dr. Frankenstein Solution

Open-loop + closed-loop solutions offered by legacy systems providers also create a confusing and counterintuitive customer experience. Why? Because to sit down at a slot machine with their cashless account, players must first make two separate transactions.

First, a player must fund the financial services provider’s wallet. Importantly, while these funds sit in custody of the financial services provider, they cannot be transferred directly to the game of the player’s choice.

Second, to put their funds into action, the player must transfer them from the financial services provider wallet into the casino’s CWA account. This confusing extra step brings no benefits to the player or casino. The only beneficiary is the systems vendor, who gets to sell an add-on to their more than 25-year-old system.

CWA solutions also add friction to the purchase process in non-gaming transactions. If a player leaves their slot machine to go make a purchase in the gift shop, funds would have to be transferred yet again from the CWA back to the financial services provider’s wallet. Casinos deploying CWA technology will also have to train players to fund the wallet compatible with their desired purchase.

Acres is the Right Way to Implement Cashless

The optimal cashless solution – Acres’ Cashless Casino – eliminates the CWA entirely, allowing for a simple, faster, more secure and more intuitive player experience.

Cashless Casino from Acres is a modern, open-loop payment system that eliminates the CWA and leaves player deposits outside the casino’s custody. As such, only one wallet is required – that of the financial services provider – and players can instantly use their funds for any gaming or non-gaming transaction. At the end of a player session, cashed out funds are instantly returned to the care of the financial services provider. Because these funds are always located in the financial services provider’s custody, the casino assumes no risk or liability to secure them. And the player benefits from a “clean” one-step offering.

Furthermore, because the Acres solution is not hampered by the added step of transferring funds staged in the CWA, any number of funding solutions can be integrated with the slot machine, including bonuses driven by the cashless funding process and/or funded by external sponsors. Messages and bonuses can be highly tailored to each player for maximum efficiency, driven by the Acres Foundation hardware’s unique ability to deliver 100% of machine data in real-time. Any reliance upon the outdated CWA infrastructure ensures cashless funding is merely another funding option of the same player experience, while Foundation and Cashless Casino are designed to fundamentally change the experience to attract new players.

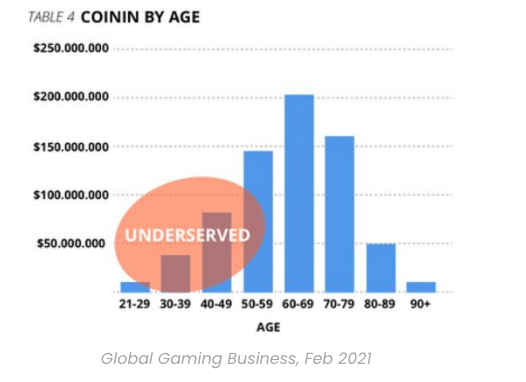

Cashless Gaming as a Catalyst for Increasing Participation of Younger Demographic

The pandemic accelerated business and consumer adoption of funding technologies that enable contactless transactions which are convenient and secure. As such, transactions via online or mobile tools are a fast growing and increasingly preferred means for consumers to conduct retail and e-commerce transactions. In 2021, over 80% of all non-casino gaming consumer financial transactions were accomplished without cash. In addition, cashless technology has been universally adopted for online gambling in the U.S. and Europe, accounting for 100% of online gambling transactions.

At the same time, the pandemic led to new, younger players visiting casinos for the first time and this cohort is critical to the casino industry’s ongoing success. These younger generations, under age 50, accounted for less than 20% of U.S. slot revenue in 2021. Having grown up with the advantages that technology innovations offer in their consumer transactions, the introduction of a seamless cashless gaming experience will be critical to foster their consistent engagement with casino floor offerings.