Aristocrat Announces FY 2022 Results

Aristocrat delivers strong profit growth reflecting diversification and business resilience

Sydney, 16 November 2022 KEY HIGHLIGHTS • Successful execution of growth strategy leading to market share gains across key and emerging segments

• 27% growth in normalised NPATA to $1.1 billion (up 20% in constant currency) achieved after maintaining organic and inorganic investment for future growth

• Sustained investment in people, product and innovation to continue growth momentum

• Continuing to invest in online Real Money Gaming (RMG) business with launch of Anaxi

• Strong cash flow generation and balance sheet with liquidity of ~$3.8 billion1

• Continued execution of capital management strategy including $340 million on-market share buy-back (68% of up to $500 million)

Aristocrat Leisure Limited (ASX: ALL) today announced its financial results for the 12 months ended 30 September 2022.

Aristocrat delivered a high quality result, with strong revenue and profit growth reflecting sustained investment in top-performing product portfolios, differentiating capabilities, increased operational diversification and business resilience.

Normalised profit after tax and before amortisation of acquired intangibles (NPATA) of $1,099.3 million represents an increase of 27% in reported terms, and 20% in constant currency, compared to the prior corresponding period (PCP). This was driven by exceptional performance in North American Gaming Operations and global Outright Sales, despite supply chain disruptions and mixed operating conditions across key markets.

Aristocrat Chief Executive Officer and Managing Director, Trevor Croker, said “Aristocrat’s performance underlines the ongoing implementation of our growth strategy. Throughout the year, we continued to invest in competitive product portfolios to drive further share growth across key segments, greater operational diversification and deeper business capability.

“Aristocrat delivered an increase in revenues of almost 18% year on year, and an annual profit of $1.1 billion that exceeded our 2019 financial year performance by approximately 23%. This highlights the strength of our post-COVID recovery and our ability to execute in a challenging environment.

“Strong performance in Aristocrat Gaming more than offset headwinds in the Pixel United business, again highlighting the increasing diversification and resilience of our Group.

“We have made further progress in our ‘build and buy’ strategy to scale in online RMG, with the launch of our new business, Anaxi. While we are focusing first on the North American i-Gaming vertical, we ultimately aim to be the leading gaming platform within the global online RMG industry. We will continue to invest behind this key adjacent growth opportunity as we build Anaxi over the medium-term.

“Aristocrat took significant steps forward in leadership and capability, while continuing to execute against our ambitious ESG commitments. This included preparatory work to allow us to set a science-based emissions reduction target for the Group in calendar 2023. In addition, we made progress in our responsible gameplay agenda, rolled out an enhanced anti-modern slavery training programme and achieved an above-benchmark employee engagement score for the year.

“Our performance highlights the incredible resilience and commitment of our team of over 7,500 people around the world. I want to thank each of our people for their hard work, and their care for each other, as we navigated the conflict in Ukraine and other challenges across the year.

“As we look ahead, we believe that Aristocrat’s outstanding product portfolios, growing operational resilience and capability, along with a highly engaged team and strong culture, positions us well to maintain our momentum despite uncertain conditions,” Mr Croker concluded.

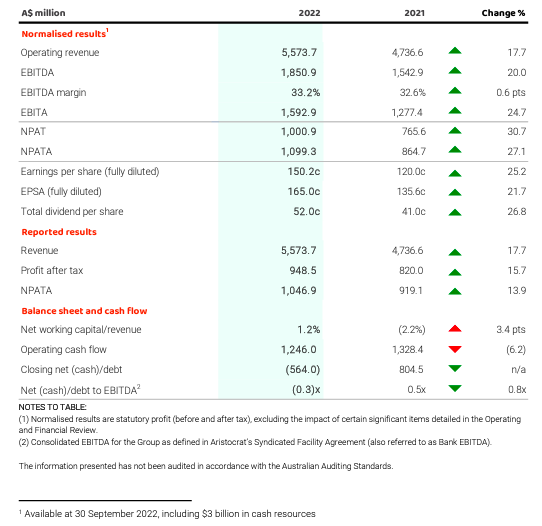

FINANCIAL SUMMARY

Group revenue increased to $5.6 billion, representing a 17.7% increase in reported terms and 12.0% in constant currency compared to the PCP.

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of $1,850.9 million was 20% higher on a reported basis and 14% higher on a constant currency basis compared to the PCP.

Strong operating cash flows and superior financial fundamentals were maintained, ensuring the business retains full strategic optionality and the ability to fund both organic investment and inorganic acceleration options.

The Group’s balance sheet maintained the business’ optionality, with a net cash position of $564 million and liquidity of $3.8 billion at 30 September 2022.

The Directors have authorised a final fully franked dividend of 26.0 cps (A$171.5 million)2 for the period ended 30 September 2022, taking the full year fully franked dividends to 52.0cps (A$345.3 million)2. The record and payment dates for the final dividend are 1 December 2022 and 16 December 2022, respectively.

Cash of $660 million was appropriately returned to shareholders through dividends and onmarket share buy-back, in line with the Group’s established capital allocation framework.

OPERATIONAL HIGHLIGHTS

Aristocrat’s portfolio of scaled, world-class Gaming and Pixel United assets continued to grow and diversify over the 12 months to 30 September 2022, off the back of ongoing investment and high quality execution.

This was driven by exceptional performance in North American Gaming Operations and global Outright Sales, despite supply chain disruptions and mixed operating conditions across key markets.

Pixel United delivered a resilient performance in a challenging environment, as overall mobile bookings moderated post COVID-driven peaks in the PCP.

Through the second half, Aristocrat continued to protect its people and business in Ukraine, providing comprehensive support to employees. Around three quarters of our people were assisted to relocate to safer places within Ukraine or abroad. Operational disruptions were minimised by leveraging capability across the Pixel United business, with new studios opened in Poland, Spain and Canada, and Ukraine utilisation rates were approaching pre-conflict levels at period end.

Aristocrat made significant progress in executing its ‘build and buy’ strategy to scale in online RMG, with the launch of its new business, Anaxi. Online RMG is a material growth and diversification opportunity that will provide further channels for the distribution of the Group’s world-leading content.

The Group continued to invest strongly in product and technology, along with innovation, operational excellence and customer engagement, to drive further share growth across key markets, segments and game genres. Design and Development (D&D) investment remained at a market-leading 12%, and disciplined User Acquisition (UA) was also delivered.

Highlights for the period included: Aristocrat Gaming:

• Strong revenue growth across Americas and ANZ led by increasing product portfolio depth and strength, with Class III Premium installed base growing by 14.0% to 31,595 units and Class III and Class II FPD increasing by 8.5% to US$55.78;

• Americas margin expanded 2.7 percentage points to 56.1%, driven by revenue growth and strong management of the installed base, more than offsetting higher input costs driven by supply chain challenges;

• Americas Outright Sales units up 66%, fuelled by larger customer capital commitments and increased product penetration, with MarsXTM and MarsXTM Portrait cabinets driving Average Selling Price up 8%; and

• Expansion into attractive adjacent markets continues, with growth in VLT and Washington CDS, and entry into Kentucky Historical Horse Racing and New York Lottery.

Pixel United:

• Gained further share overall and maintained its status as a Top 5 mobile games publisher in Tier-1 western markets3, with 6 of the top 100 mobile games in the US across multiple genres at 30 September 2022;

• Retained leading positions in key genres, including #1 position in the Social Slots segment, #2 in the broader Social Casino genre, #1 in the Squad RPG (Role-Playing Games) segment and #3 in the Casual Merge segment according to industry data (Sensor Tower);

• Average Bookings Per Daily Active User (ABPDAU) grew 11%, driven by improved performance in Social Casino and RPG, Strategy & Action;

• Moved proactively to cease operating its mobile games in Russia during the year. This market historically contributed approximately 3% of annualised Pixel United bookings, primarily in the Plarium portfolio; and

• Continued to strengthen and diversify operations for future growth, including opening new studios in Poland, Spain and Canada, and bringing further game development capabilities to the business.

OUTLOOK

Aristocrat expects to deliver NPATA growth over the full year to 30 September 2023, assuming no material change in economic and industry conditions, reflecting:

• Continued strong revenue and profit growth from Aristocrat Gaming, underpinned by market-leading positions and recurring revenue drivers in Gaming Operations;

• Lower growth in bookings and profit from Pixel United, compared to recent years; and

• Further investment in Anaxi, to support our online RMG ambitions.

Over the medium-term, Aristocrat aims to:

• Continue to gain market share in all key segments;

• Deliver high quality, profitable growth;

• Continuously invest in D&D to improve competitiveness and breadth of product;

• Invest to diversify our business in line with strategy; and

• Effectively manage capital to support long-term growth and maximise shareholder returns.

Additional details for FY23 modeling inputs are available in the Investor Presentation at https://ir.aristocrat.com/company-news-performance/results-presentations