Latest Gaming News

LONDON, Sept. 14, 2021 /PRNewswire/ -- International Game Technology PLC ("IGT") (NYSE: IGT) announced today that Knute Knudson, Jr., Vice President of Global Business Development and Tribal Ambassador, will be inducted into the American Gaming Association's (AGA) Gaming Hall of Fame as a member of the Class of 2021. Knudson will be honored on October 5 at the AGA's Chairman's Reception during the Global Gaming Expo in Las Vegas, Nev.

Induction into the Gaming Hall of Fame is the highest honor accorded by the gaming industry. Each year, two or more individuals who have distinguished themselves through significant contributions receive this honor. Gaming Hall of Fame honorees are selected by an independent panel of gaming leaders.

"Knute's dedicated support and committed advocacy of tribal gaming expansion and sustained health and well-being of Indian country are unmatched in our industry," said Renato Ascoli, IGT CEO, Global Gaming. "Knute is a true champion of tribal gaming—a constant source of knowledge, guidance, and support to hundreds of tribes throughout his lengthy career. IGT is incredibly proud that Knute's impact as a strategic partner and dedicated friend to Indian Country is being recognized with an induction into the AGA's Gaming Hall of Fame."

"I am distinctly honored and thrilled to be accepted into this esteemed group of AGA Gaming Hall of Fame honorees," said Knudson. "The advancement of Indian gaming, tribal self-sufficiency, and, importantly, Tribal Sovereignty has been my life's work, and my success is intricately tied to Indian people who have trusted me to advance their causes and expand gaming opportunities on their behalf. I am grateful for their confidence, partnerships and friendships and thank IGT for its continued support."

For more information about IGT visit igt.com and follow us on LinkedIn.

About Knute Knudson, Jr.

Knudson has been an advocate and proponent of Indian gaming for three decades. As Deputy Chief of Staff at the Department of the Interior from 1989 to 1993, Knudson led efforts to implement the Indian Gaming Regulatory Act, working on compacts, trust applications, and National Indian Gaming Commission (NIGA) appointments.

After joining Sodak Gaming, Knudson played an integral role in securing economic self-sufficiency for Indian Country throughout the 1990s, financing more than $1.5 billion in equipment and systems sales to tribes looking to start gaming businesses. Knudson authored "Getting Started in Indian Gaming" which became a blueprint for the first decade of tribal gaming startups.

Knudson testified in front of Congress, state legislatures, and regulators as an advocate of tribal gaming, constantly navigating the complexities of policy and practice to identify and address the needs of Indian people and culture. In the early 1990s, Knudson successfully presented the case to the Department of the Interior and NIGA that linked Wide Area Progressive games were permissible under the Indian Gaming Regulatory Act. This led to the launch of the Native American Progressive System (NAPS) in 1994.

Today, Knudson continues to advance the interests of tribal gaming growth, Sovereignty, and prosperity. His work for IGT brings the latest technology, branded content, and proven core games to tribes to grow casino revenues and strengthen tribal self-sufficiency and economic independence.

Knute has been honored by dozens of tribal governments and associations and, in 2018, he was honored with NIGA's Lifetime Achievement Award.

Acres Manufacturing is also the sponsor of Fantini Research’s highly anticipated At-Booth Product Demo Series that will return this year at G2E’s in-person event.

“We are excited to return to a live G2E this year and are especially excited to have legendary gaming innovator John Acres and Acres Manufacturing step up as presenting sponsor for all of our gaming show content throughout 2022,” CEO Frank Fantini said.

“We are proud to partner with Fantini Research as the 2022 Global Presenting Sponsor and sponsor of the Fantini At-Booth Product Demos at G2E 2021. Our history of innovation continues at Acres Manufacturing with Foundation – a game changing casino management system that provides real-time data, instant bonusing and a single wallet cashless solution compatible with any slot machine or table game. We look forward to G2E 2021,” Acres Manufacturing CEO John Acres said.

“We also are proud that International Game Technology and Ainsworth Game Technology are returning as major sponsors as well as all of our sponsors whose generosity allows us to present industry-leading content throughout the year,” Fantini said.

IGT is sponsor of the always popular G2E CEO One-on-One video interviews and, throughout the year, the CEO Insights series in which gaming’s top CEOs lend their understanding of trends shaping the future. Current interviews in that series can be viewed at https://www.fantiniresearch.com/conventions/ceo-insights.html.

Ainsworth is the sponsor of all news and exhibitor updates for both Fantini’s G2E 2021 coverage and all trade shows throughout 2022 as the Global Trade Show News sponsor.

Other sponsors:

GAN - Sponsor of Fantini's Gaming Show: A Virtual Trade Show where companies exhibit their newest products and news throughout the year: https://www.fantinisgamingshow.com/

Everi – Sponsoring Emerging Insights interviews in which CEOs discuss emerging companies and trends: https://www.fantiniresearch.com/conventions/emerging-insights.html

Gaming Laboratories International (GLI) - Public Policy Insights sponsor in which regulators and legislators discuss public policies affecting the industry: https://www.fantiniresearch.com/conventions/public-policy-insights.html.

Global Payments Gaming Solutions - Investor Insights in which the best investors in gaming share their best ideas: https://www.fantiniresearch.com/conventions/investor-insights.html.

Advantage Level Sponsors make possible much of the content presented at G2E:

Galaxy Gaming, Gaming Arts, Catena Media, and Axes Network.

https://www.fantiniresearch.com/conventions/g2e/g2e-2021-sponsors.html

~~~~~

Anyone interested in becoming an Advantage Sponsor, please contact Ashley Diem at ADiem@FantiniResearch.com.

ABOUT FANTINI RESEARCH

Fantini Research publishes newsletters and provides research services for C-level executives, institutional investors and legal and regulatory professionals in the global gaming industry. The flagship product is the daily Fantini’s Gaming Report, the industry’s standard source of comprehensive and timely news and analysis. Fantini’s Public Policy Review is the legal journal of the gaming industry providing news and analysis of legislative, legal and regulatory developments. It is published every Monday and with real-time bulletins as events happen. Other publications include the monthly Fantini’s National Revenue Report, a monthly compilation and analysis of US gaming revenues and trends; and, in partnership with Eilers & Krejcik Gaming, the EILERS-FANTINI Quarterly Slot Survey, and the EILERS-FANTINI Game Performance Report, which is a monthly report on slot performance; and the Fifth Third-Fantini Distributed Gaming Report. Fantini Research also performs research services for gaming companies and investors. Visit the website at www.FantiniResearch.com.

LAS VEGAS, Sept. 13, 2021 /PRNewswire/ -- Everi Digital, the online gaming division of Everi Holdings Inc. (NYSE: EVRI) ("Everi" or "the company"), a premier provider of land-based and digital casino gaming content and products, financial technology, and player loyalty solutions, announced it has partnered with BetMGM to launch the custom-themed game "Borgata 777 Respin."

Delivered via Everi's proprietary Spark Remote Game Server™, the Borgata 777 Respin game is the first title Everi has developed in coordination with BetMGM. It is currently available through BetMGM Casino, Borgata Casino, and Party Casino in New Jersey, and on BetMGM Casino and Borgata Casino in Pennsylvania.

"This rewarding collaboration with BetMGM brings online gamers a thrilling new title that adds to and enhances our award-winning stepper, video slot, and progressive jackpots content offerings," said David Lucchese, Executive Vice President of Sales, Marketing, and Digital for Everi. "BetMGM is a trusted operator-partner and is committed to our collective goal of delivering memorable experiences to players."

Borgata 777 Respin offers a re-spin bonus that triggers randomly on any winning spin and each re-spin awards prizes equal to or more valuable than the previous re-spin. Through wild Borgata symbols, players also gain the opportunity for wins with 10x, 5x, and 3x multipliers.

"Everi has a reputation for developing engaging content and has delivered an incredible title in Borgata 777 Respin, a game sure to resonate with our players," said Oliver Bartlett, BetMGM's Director of Online Gaming. "BetMGM continues to leverage its strong themes and iconic brands to build the most robust online gaming portfolio and we're thrilled to provide players with another exciting gaming option."

|

|

|

|

|

|

Ainsworth Game Technology Limited today announced that Mr Lawrence Levy has advised the Company of his intention to resign from the role of Chief Executive Officer (CEO) effective Friday 10th September 2021.

The Company further advised that it has been agreed with Mr Harald Neumann that he will be appointed as the new Chief Executive Officer commencing 1st October 2021.

Mr Neumann’s appointment in the role is subject to regulatory approvals and the completion of contractual details. Mr Neumanns’ remuneration terms are expected to be similar to Mr Levy’s and will be released to ASX on completion.

Mr Neumann has been a director of Ainsworth since February 2017. Mr Neumann will remain a director of the Company at the present time, albeit from the 1st of October in an executive capacity.

Mr Mark Ludski, Chief Financial Officer will undertake the additional role of interim CEO until the appointment of Mr Neumann takes effect to ensure continuity of leadership and oversight of the Company’s operations.

Mr Danny Gladstone, Chairman said, “On behalf of the Board, we thank Lawrence for his contribution through challenging times. Lawrence has decided to resign for personal reasons, and we wish him well.

We are fortunate to be able to appoint Harald as our new CEO. As the former successful CEO of Novomatic AG, our major shareholder, and a director of AGT, he brings a wealth of knowledge and experience to the role with a thorough understanding of AGT. He will be able to seamlessly transition to the new position. Harald will be based in Las Vegas where he can lead AGT in our largest market continuing to drive growth and recovery.”

This announcement was authorised for lodgement by the Board of Directors.

LONDON, Sept. 8, 2021 /PRNewswire/ -- International Game Technology PLC (NYSE: IGT) ("IGT" or the "Company") today announced that it has established a dedicated Digital & Betting business segment, comprising its iGaming and sports betting activities that were previously part of the Global Gaming segment. As a result, beginning with the third quarter of FY2021, IGT will report results under three business segments: Global Lottery, Global Gaming and Digital & Betting. The IGT iLottery business will remain part of the Company's Global Lottery segment.

Enrico Drago will serve as CEO, Digital & Betting, reporting to Marco Sala, CEO of IGT, effective immediately. Drago, 44, previously had oversight of the IGT iGaming, iLottery and sports betting businesses as Senior Vice President, PlayDigital.

"IGT has established strong leadership positions and driven dynamic growth across its iGaming and sports betting businesses. With significant growth expected to continue, we have decided to establish a dedicated Digital & Betting business segment," said Marco Sala, CEO of IGT. "These businesses have become strategically important to IGT as they afford us the opportunity to leverage the global reach and strong customer relationships of our Global Gaming segment. The new structure gives us more flexibility in our product and solutions portfolio and enables better appreciation of the intrinsic value of these activities."

In advance of its third quarter 2021 earnings call, the Company expects to provide a recast of its historical financials to reflect the new segment disclosure.

In addition, due to the increased restrictions and ongoing uncertainty surrounding COVID-19 and its Delta variant, IGT has decided to hold its Investor Day event virtually and has moved its date to November 16, 2021. More information on the event will be forthcoming.

Executive Biography

Prior to his appointment as CEO, Digital & Betting, Enrico Drago served as Senior Vice President of PlayDigital from July, 2018, leading a fast-growing and award-winning portfolio of digital gaming/lottery and sports betting products, platforms and services. He has also served as Vice Chairman of De Agostini S.p.A., since June, 2021. As of June 30, 2021, De Agostini S.p.A. held approximately 50.40 percent of IGT's ordinary shares and approximately 64.98 percent of the voting rights attaching to IGT's ordinary shares. Drago also has served as an advisor for Nina Capital, a leading European venture capital firm focused on health technology companies, since 2019. He is the son of Marco Drago, a member of IGT's Board of Directors and the Chairperson of De Agostini S.p.A.

In 2014, Enrico Drago joined IGT as Chief Operating Officer for subsidiary Lottomatica, overseeing the Italian business strategy and operations. In 2017, he took on the role of Senior Vice President Global Interactive, Sports Betting and Licenses. Prior to joining IGT, he led teams for Inditex Italia, which he joined through a leadership program for high-potential managers. Drago was selected as the Italy Chief Operating Officer for brands Bershka, Pull & Bear, Zara Home, Oysho, Stradivarius and Massimo Dutti and appointed as Inditex Italia Managing Director in 2011. Prior to his roles with Inditex Italia, Drago worked with Puig Beauty and Fashion.

LONDON, Sept. 2, 2021 /PRNewswire/ -- International Game Technology PLC ("IGT") (NYSE: IGT) announced today that its world-class PlaySports platform footprint will expand into Wisconsin through an agreement to power sports betting at Oneida Casino, on the Oneida Nation Reservation. Operated by the Oneida Nation, Oneida Casino, located at 2020 Airport Drive in Green Bay, will leverage IGT's turnkey PlaySports solution for retail and mobile sports betting. The Oneida Nation is the first tribe in Wisconsin to receive approval from the State government to operate a sports betting program at a casino.

"We look forward to partnering with IGT to introduce sports betting to our loyal patrons and becoming the first casino in Wisconsin to operate a sportsbook," said Louise Cornelius, Oneida Casino Gaming General Manager. "Implementing IGT's proven PlaySports platform and trading advisory services will strongly enhance Oneida Casino as a premier gaming destination."

"IGT applauds the Oneida Nation for being the first tribe in Wisconsin to re-negotiate its compact with the State and position themselves to reap the long-term benefits of deploying IGT's world-class PlaySports solution," said Enrico Drago, IGT PlayDigital Senior Vice President. "We're committed to supporting Oneida's sports betting vision and producing the highest quality technology, solutions, and services to successfully launch and sustain its sports betting operations."

For more information about IGT PlaySports, visit igt.com/PlaySports or visit us on LinkedIn.

Next gen robots rumble and roll in a never-before-seen casino slot series

Las Vegas, NV — September 1, 2021

BattleBots, the world’s premier robot combat competition, announced the first official BattleBots casino slot games. Developed by Konami Gaming, Inc., a global leader in casino gaming, the industry’s first BattleBots slot machine is now previewing to the public at Caesars Entertainment Studios during the new season taping and 2021 World Championship. This never-before-seen slot game includes some of BattleBots’ most iconic robot competitors like Tombstone, Witch Doctor, HyperShock, and more. BattleBots slots take players on a combat to cash as robots strike, swing, shove, slice, and smash with each spin, toward the win!

“For more than two decades, BattleBots fans have taken part in the competition’s most exciting moments. Now BattleBots slots are taking robot fighting time to the casino floor, as another way to join in iconic scenes and machines from the show—with a cash chance,” said Edward Roski (Trey), BattleBots creator and CEO. “Teams and audiences here at the 2021 World Championship event have been truly wowed by the slot game’s unique creativity and massive presence. We’re thrilled to work with Konami to bring BattleBots to the gaming arena.”

“When people across the world watch BattleBots, it gives a sense of excitement, competition, curiosity, and wit unlike any other competition. There is no combat sport quite like BattleBots. And there’s no casino slot quite like BattleBots,” said Tom Jingoli, executive vice president & chief operating officer at Konami Gaming, Inc. “We put the BattleBox into a casino slot—where the battle is a bonus and the Giant Nut is a Grand Jackpot.”

The new BattleBots slot series is displayed at the live taping of BattleBots Season 6, at Caesars Entertainment Studios in Las Vegas through September 4, 2021. Tickets are available to the public ($40-$200) and can be purchased by visiting the BattleBots ticketing page. The new BattleBots linked progressive jackpot game is shown on Konami’s newest game machine hardware DIMENSION 75C™, with 75-inch curved screen in 4K Ultra High-Definition (UHD). Konami will also be making the series available on its award-winning DIMENSION 49J™ machine, with 49-inch “J-curve” display in 4K UHD. The slot game’s general release is scheduled for next year.

For more information about Konami Gaming, Inc., please visit www.konamigaming.com.

About BattleBots

BattleBots is the most popular robotic combat sport in the world, now seen in over 150 countries. The famous reality TV show and live event feature custom built, remote-controlled robots, designed and operated by competitors to fight in an area combat elimination tournament. Created by Ed Roski and Greg Munson, BattleBots is produced by BattleBots, Inc. and Whalerock Industries. Executive producers are Chris Cowan, Edward Roski (Trey), Greg Munson, Tom Gutteridge, Aaron Catling, and Evan Gatica. For more information about BattleBots, please visit battlebots.com.

About Konami Gaming, Inc.

Konami Gaming, Inc. is a Las Vegas-based subsidiary of KONAMI HOLDINGS CORPORATION (TSE: 9766). The company is a leading designer and manufacturer of slot machines and casino management systems for the global gaming market. For more information about Konami Gaming, Inc. or the SYNKROS® gaming enterprise management system, please visit www.konamigaming.com.

|

|

|

|

|

August 26, 2021 - Australian slot machine supplier Ainsworth Game Technology has reported a loss before tax of AU$59.2 million for the 12 months to 30 June 2021, although just AU$2.6 million of that loss was recorded in the second half of the financial year.

The FY21 loss, widened from a loss of AU$43 million in 2020, came despite a 7% increase in revenue to AU$159.5 million, where gains in the North American and Australian markets offset a significant decline in Latin America.

Ainsworth said the FY21 loss would have only been just AU$17.1 million if not for currency translation impacts and one-off items, with a 1H21 loss of AU$18.7 million and 2H21 profit of AU$1.6 million.

Adjusted EBITDA of AU$15.5 million, up from AU$5.8 million a year earlier, included EBITDA of AU$1.1 million for the first half of FY21 and AU$14.4 million in the second half.

According to Ainsworth’s FY21 results release, international markets contributed 76% of the group’s total revenue at AU$120.5 million, with revenue from North America up 23% year-on-year to AU$88.5 million.

The Australian region also performed well, with revenue up 38% year-on-year and EBITDA by 15% to AU$5.4 million including increases in all states except Victoria. Ainsworth added that despite current uncertainties across Australia due to COVID-10 lockdowns in Victoria and New South Wales, customers are c continuing to invest in their gaming floors in preparation for when venues reopen.

However, revenues in Latin America fell 56% in FY21 to AU$18.3 million with mandated closures and restricted access in Mexico, Argentina and Peru impacting results.

Ainsworth reported a 28% increase in online revenue to AU$5.9 million after launching real money gaming in New Jersey in April 2020.

Ainsworth's presentation is at: https://www.agtslots.com/assets/ASX-Release---Financial-Results-FY21_Presentation-1630034518.pdf

Cavalcade of Innovation

New product demo now available from

Ainsworth

A STAR Curve XL

The A STAR Curve XL is Ainsworth’s newest and largest premium cabinet featuring a 4K, 55-inch floating infinity monitor and 27-inch LCD topper. The cabinet was specifically built for high-denomination linked progressive games.

View the video at: https://www.fantiniresearch.com/conventions/cavalcade-of-innovation.html

The Cavalcade of Innovation is sponsored by Ainsworth.

Companies also showcasing products on the Cavalcade include Aristocrat, Aruze,

Eclipse Gaming, GAN, GameCo, Incredible Technologies, Konami and others.

The Cavalcade of Innovation is a year-round series that features select innovative new products with quick video demos, all in one spot. All videos can be found at https://www.fantiniresearch.com/conventions/cavalcade-of-innovation.html.

Companies interested in displaying new products in the Cavalcade of Innovation

should contact VP of Fantini’s Gaming Show Dee Wild-Shyver at DWild@FantiniResearch.com or at +1 302 730 3793.

In addition to the Cavalcade of Innovation, Fantini’s Gaming Show site exhibits companies and products along with announcements of other corporate developments and news with 24/7/365 availability, at https://www.FantinisGamingShow.com. To become an exhibitor contact Dee Wild-Shyver using the above contact information.

|

|

|

|

“This passion project has been our best-kept secret over the past year, as we’ve persevered through the global pandemic and brought together all the moving parts in order to make this happen,” said General Manager, Rick Scheer. “On August 24 we will make history as we open the doors to our first-ever Sportsbook.”

BETTING ON UTE MOUNTAIN

Led by Jay Petrick, Sportsbook Manager, the Ute Mountain Sportsbook will surround guests with sixteen 55” LED screens and a dominating 98” LED screen to display featured events and odds. Positioned in the center of the venue exists a relaxed seating area with over 25 spots available for reservations. Players will have access to three operated betting stations, four self-serving kiosks and a designated cage for large bets.

“Our goal is to create the ultimate betting experience by fusing the world-class services provided by IGT with the local essence of the Ute Mountain Ute Tribe,” said Petrick.

Aristocrat Leisure Limited (ASX: ALL) today announced that it has entered into a number of deals to further expand its world-class Digital game development capability, in line with its growth strategy. The investments are strongly aligned to targeted genres, particularly the highgrowth casual and merge segments where Aristocrat Digital already has a presence, and the social casino segment, in which the business has a market-leading position globally.

In total, three new studios will join Aristocrat Digital, deepening the business’ access to game development talent and studio capabilities in top-tier mobile game talent hubs across Northern and Eastern Europe. Details are as follows:

- Aristocrat has agreed to acquire Helsinki-based free-to-play mobile gaming studio Futureplay, which specialises in the growing merge/match 3 segment of the casual market. Founded in 2015, Futureplay has released six games that have been played by over 140 million users around the world, including titles such as Merge Gardens, Idle Farming Empire and Battlelands Royale. Futureplay will operate under the proven leadership of Jami Laes, as a studio reporting within Aristocrat’s Plarium business. This will bring together Plarium’s best-in-class game development infrastructure and marketing expertise with Futureplay’s outstanding casual mobile capabilities enabling Plarium to expand and diversify their portfolio (which includes the global sensation RAID: Shadow Legends).

- Given talent opportunities in the region, Aristocrat has established a further Helsinkibased studio, Northern Stars. Northern Stars will focus on the emerging hybrid casual genre under the world-class game development and studio leaders, Minwoo Lee (ex EA, Rovio, Ubisoft) and Antti Nikander (ex Rovio). Minwoo and Antti bring a wealth of experience to the Group, which will help us grow Aristocrat’s presence in Finland and further expand our game development capabilities.

- Aristocrat has acquired Playsoft, the Gda?sk (Poland) based mobile gaming studio specialising in the social casino genre. Playsoft has a 13+ year track record of developing more than 50 successful game titles for third party partners. Playsoft will operate within the Product Madness business, and continue to be led by its impressive founders Nicolas Bensignor and Pierre Olivier Monteil. The studio will help accelerate Product Madness’s pipeline and deliver innovation, while establishing a strong footprint for the company in another strategic European location.

Aristocrat Digital’s CEO, Michael Lang, said “These deals are consistent with Aristocrat’s successful strategy of bringing more world-class game development talent and capability into the organisation to expand our game pipeline and sustain our strong growth momentum in

Digital.”

“We are thrilled to welcome Futureplay, Northern Stars and Playsoft to the Aristocrat Digital family, given their impressive track records in game development, creativity and innovation. Coupled with Aristocrat Digital’s ambitious strategy, global scale, marketing and investment

capabilities, we look forward to helping our new colleagues reach new heights as part of Aristocrat.”

“We will continue to be active in pursuing global talent and studio deals that accelerate our growth strategy, alongside our sustained proven focus in driving organic growth and abovemarket results” Mr Lang concluded.

High-performing core content on premium-caliber cabinet elevates player experiences in California

IGT announced today that its PeakSlant49™ cabinet with high-performing video core content is now entertaining players at San Manuel Casino in Highland, Calif. The casino currently features 132 PeakSlant49 cabinets with the initial themes of Stinkin’ Rich® Skunks Gone Wild and Regal Riches™.

The addition of these cabinets and games was part of the resort’s recently completed expansion that included 1,500 slot machines and the unveiling of an enlarged gaming space. Players at San Manuel Casino were among the first in the country to enjoy IGT’s legendary core games on this premium-caliber cabinet.

“Driving innovation and delighting players has been San Manuel Casino’s priority for 35 years,” said Peter Arceo, General Manager of San Manuel Casino. “With IGT’s PeakSlant49 cabinets, San Manuel Casino can offer our valued guests a pipeline of IGT’s preferred core content for years to come, aligning brilliantly with our promise to always deliver exceptional entertainment to our customers.”

“San Manuel Casino being among the first gaming venues in the U.S. to offer IGT core games on the PeakSlant49 cabinet is consistent with the casino’s reputation for embracing future-forward solutions that elevate the player experience,” said Ken Bossingham, IGT’s Senior Vice President of Sales, Gaming. “Stinkin’ Rich Skunks Gone Wild and the high-performing Regal Riches games are a few of IGT’s Proven Performer titles that vividly stand out in ultra-high definition on our premium-caliber PeakSlant49 cabinet.”

IGT initially launched the PeakSlant49 cabinet as a premium, for-lease cabinet in 2020, but in May 2021 the Company announced it was extending the hardware to its for-sale cabinet portfolio.

The PeakSlant49 video slots cabinet is an attention-grabbing focal point on any casino floor. The cabinet’s 49-inch, progressively curved Ultra-HD display is complemented with a 27-inch video topper. The cabinet’s intelligent lighting and player-convenience features such as an inductive wireless charger, USB port and comfortable 13.3-inch dynamic player panel all contribute to the hardware’s popularity and strong performance.

LAS VEGAS, Aug. 16, 2021 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB:GLXZ), a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming, announced today its financial results for the fiscal quarter ended June 30, 2021.

Financial Highlights Q2 2021 vs. Q2 2020

- Revenue increased to $4,749K from $664K

- Adjusted EBITDA1 increased to $2,147 from a loss of $(1,420)K

- Net income of $550K vs. a net loss of $(2,207)K

- Net Income per share (diluted) of $0.03 vs net loss per share (diluted) of $(0.12)

H1 2021 vs. H1 2020

- Revenue increased to $9,032K from $5,158K

- Adjusted EBITDA2 increased to $3,840K from $80K

- Net income of $639K vs. a net loss of $(2,090)K

- Net Income per share (diluted) of $0.03 vs net loss per share (diluted) of $(0.12)

Balance Sheet Changes (vs. December 31, 2020)

Cash decreased 4% to $5,780K

Total debt (gross) decreased to $50,767K from $51,914K Stockholders’ deficit decreased to $(23,431)K from $(24,797)K

Executive Comments

“The second quarter of 2021 showed a welcome improvement in our land-based business and continued growth in our online business,” said Todd Cravens, Galaxy’s President and CEO. “Revenue in our land-based business increased from $2,826K in Q1 2021 to $3,183K in Q2 2021 despite casinos in the UK – our largest land-based market – remaining closed until mid-May. In the online business, revenue (net of royalties) increased to $1,566K in Q2 2021 from $1,457K in Q1 2021. We expect an acceleration on online revenue growth in the second half of 2021 as, among other things, live-dealer gaming through our largest client goes live in Michigan.”

“Cash declined modestly in Q2 2021 due primarily to the annual payment of $782K in accrued share redemption consideration in Q2 2021,” stated Harry Hagerty, Galaxy’s CFO. “We were in compliance with the covenants in our bank debt with the exception of minimum EBITDA, and the bank has agreed to forebear enforcement of a violation of that covenant through Q3 of 2021.”

Forward-Looking Statements

Certain statements in this release may constitute forward-looking statements, which involve a number of risks and uncertainties. Galaxy cautions readers that any forward- looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that Galaxy files with the Securities and Exchange Commission.

About Galaxy Gaming

Headquartered in Las Vegas, Nevada, Galaxy Gaming (galaxygaming.com) develops and distributes innovative proprietary table games, state-of-the-art electronic wagering platforms and enhanced bonusing systems to land-based, riverboat, cruise ships and online casinos worldwide. Through its iGaming partner Games Marketing Ltd., Galaxy Gaming licenses its proprietary table games to the online gaming industry. Galaxy’s games can be played online at FeelTheRush.com. Connect with Galaxy on Facebook, YouTube and Twitter.

| Contact: | |

| Media: | Phylicia Middleton (702) 936-5216 |

| Investors: | Harry Hagerty (702) 938-1740 |

1 Adjusted EBITDA excludes expenses related to our litigation with Triangulum of $80K in Q2 2021 and $480K in Q2 2020.

2 Adjusted EBITDA excludes expenses related to our litigation with Triangulum of $330K in 1H 2021 and $653K in 1H 2020.

Sequential Revenue Growth of 24%, Driven by Strong International Results in B2C Segment

Reiterates Revenue Guidance of $125 - $135 Million, or 270% yr/yr Growth at the Mid-point

Signed Exclusive Deals with Ainsworth and Incredible Technologies Further Augmenting

Content Portfolio

Irvine, California | August 16, 2021: GAN Limited (the “Company” or “GAN”) (NASDAQ: GAN), a

leading full-service Internet gaming software-as-a-service provider to the real-money Internet gaming

(RMiG), online sports betting, and simulated gaming (SIM) industries, today announced its operating and financial results for the second quarter ended June 30, 2021.

Dermot Smurfit, CEO of GAN stated: “Our business momentum accelerated through the first half of 2021, as we continue to scale the business and build significant brand awareness across our key business-to-business (B2B) and consumer facing (B2C) end-markets. This was highlighted by a very strong second quarter, which included nearly 70% sequential top-line growth in our B2C segment compared to the first quarter. Additionally, our B2B US gross operator revenue grew 4% sequentially, despite a seasonably slower U.S. sports calendar. We have now supported 11 successful real money gaming launches year-to-date, including the highly successful and multi-faceted transition of Churchill Downs onto the GAN platform during the second quarter.”

“Most importantly, we made great progress in executing our long-term growth strategy during the first half of the year. This included significant development work in the integration of our new sportsbook engine into our B2B product suite, which we plan to debut at Global Gaming Expo this fall. It also was highlighted by two exciting, exclusive content deals with Ainsworth and Incredible Technologies. We continue to emphasize the importance of possessing exclusive content and an industry-leading library of the most recognizable and popular retail games. These efforts and agreements will allow us to grow our take rate from U.S. iGaming revenue and position GAN as a content supplier of choice for large operators with diverse content line-ups.”

Second Quarter 2021 Financial Highlights vs First Quarter 2021:

• Total revenues of $34.6 million versus $27.8 million, a 24% increase driven by strong growth in

the B2C segment primarily in Latin America and Northern Europe, with sports results benefitting

from higher-than-expected sports betting margin.

• B2B segment revenues of $10.6 million versus $13.5 million. The first quarter of 2021 included

$3.0 million of patent licensing revenue.

• B2C segment revenues of $24.0 million, which was a 68% or $9.7 million increase. The second

quarter included the Copa America and UEFA European Championship tournaments.

• Consolidated gross profit of $24.3 million versus $19.1 million. Gross profit increased primarily

due to increased margins within our B2C segment sports revenue stream.

• Net loss of $2.7 million versus net loss of $4.5 million. Operating expenses increased $4.7 million

to $36.4 million driven by increased personnel expense related to near-term investments in talent

and technology to meet the strong demand environment.

• Adjusted EBITDA of $4.6 million versus $1.7 million. The increase was primarily driven by

higher revenue offsetting strategic investments in talent and technology.

• Cash of $52.1 million as of June 30, 2021, which was in-line with the prior quarter. The company

has no debt.

Performance and Operational Highlights

• Gross Operator Revenue (“GOR”) (2) of $221.4 million versus $214.2 million, a 3% increase,

driven by the strong performance of GAN’s new and existing client partners, most notably in the

state of Michigan. Excluding Italy, GOR increased 4% from the prior quarter to $219.0 million.

GOR excludes our B2C segment.

• Launched major new B2B tribal and commercial operators in six states. As previously

announced, the Company launched Churchill Downs in three additional states (sportsbook and

RMiG in PA; sportsbook in CO and IN) followed by FanDuel RMiG in WV in early May 2021.

Additionally, the Company went live with Gila River (SIM for AZ) and Seneca Gaming (SIM for

NY).

• Incredible Technologies, Inc online slot portfolio. Obtained exclusive online rights to all current

and future Incredible Technologies' online games, which will grow to over 110 games during the

term of the contract. Clients of GAN for both RMiG and SIM have access to nearly 1,200 games

which now includes proven, exclusive land-based content from two leading gaming suppliers.

• In May, GAN won two EGR North America Awards: Full-Service Platform Provider and

Freeplay Gaming Supplier. GAN then followed that up with an EGR B2B Award in July for White

Label Partner of the Year.

• After the 2021 second quarter-end, the Company extended its relationship with WinStar and the

Chickasaw Nation tribe in Oklahoma (SIM) and added Treasure Island on the Las Vegas Strip

as a SIM client.

2021 Outlook

Karen Flores, CFO of GAN added: “Our strong second quarter financial results were in-line with our preannounced expectations in early July and support our confidence behind the decision to raise our full-year revenue outlook to between $125 million and $135 million. We remain in a strong financial position as we support new and existing customer launches, pursue our content acquisition strategy, grow our team and evaluate new geographies. Looking out to the second half of 2021, we expect continued strong performance from our B2C segment – particularly in Latin America and Northern Europe – as well as from our B2B segment as we gain new client wins in major markets. We also expect improvement in our profitability metrics as revenue growth begins to align with the increased scale needed to support our expanded operations.”

See the complete release with detailed financial spreadsheet at https://investors.gan.com/download/companies/270140a/Earnings%20Release/Q2_21%20Earnings%20Release%20--%20FINAL.pdf

About GAN Limited

GAN is a leading business-to-business supplier of internet gambling software-as-a-service solutions

predominantly to the U.S. land-based casino industry. Coolbet, a segment of GAN, is a market-leading operator of proprietary online sports betting technology with market leadership positions in selected European and Latin American markets. GAN has developed a proprietary internet gambling enterprise software system, GameSTACK™, which it licenses to land-based U.S. casino operators as a turnkey technology solution for regulated real money internet gambling, encompassing internet gaming, internet sports betting and social casino gaming branded as ‘Simulated Gaming.’

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s 2021 revenue guidance, the Company’s anticipated trends in revenues (including new customer launches) and operating expenses, the anticipated improvement in profitability for the second half of 2021, the anticipated launch of regulated gaming in new U.S. states, the expected integration of Coolbet’s sports betting technology and international B2C operations, the anticipated launch timing of the B2B sportsbook technology solution in the U.S., as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Readers are cautioned not to place undue reliance on any forward looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements for any reason, except as required by law.

Key Performance Indicators and Non-GAAP Financial Measures

This presentation uses certain non-GAAP financial measures as defined in Securities and Exchange

Commission rules. The Company reports financial results in conformity with GAAP, and also

communicates with investors using certain non-GAAP financial measures. These non-GAAP financial

measures are not in accordance with, nor are they a substitute for or superior to, the comparable GAAP financial measures. These non-GAAP financial measures are intended to supplement the presentation of the Company’s financial results that are prepared in accordance with GAAP.

(1) The Company excludes depreciation and amortization in certain segment calculations.

(2) The Company defines Gross Operator Revenue as the sum of its corporate customers’ gross revenue from Simulated gaming, gross gaming revenue from real money regulated iGaming, and gross sports win from real money regulated sports betting, including B2C casino and sports-betting platform gross gaming revenue. Gross Operator Revenue, which is not comparable to financial information presented in conformity with generally accepted accounting principles in the United States of America (“GAAP”), gives management and users an indication of the extent of transactions processed through the Company’s corporate customers’ platforms and allows management to understand the extent of activity that the Company’s platform is processing.

(3) The Company defines B2B Active Player-Days as unique individuals who log on and wager each day

(either wagering with real money or playing with virtual credits used in Simulated gaming), aggregated

during the respective period. By way of illustrative example: one (1) unique individual logging in and

wagering each day in a single calendar year would, in aggregate, represent 365 B2B Active Player-Days.

B2B Active Player-Days provides an indicator of consistent and daily interaction that individuals have

with the Company’s platforms. B2B Active Player-Days allows management and users to understand not only total users who interact with the platform but gives an idea of the frequency to which users are interacting with the platform, as someone who logs on and wagers multiple days are weighted heavier during the period than the user who only logs on and wagers one day.

(4) The Company defines B2B Average Revenue per Daily Active User (“ARPDAU”) as B2B Gross Operator Revenue divided by the identified number of B2B Active Player-Days. This measure allows management to measure the value per daily user and track user interaction with the platforms, which helps both management and users of financial statements understand the value per user that is driven by marketing efforts and data analysis obtained from the Company’s platforms.

(5) The Company defines B2C Active Customers as a user that places a wager during the period. This metric allows management to monitor the customer segmentation, growth drivers, and ultimately creates opportunities to identify and add value to the user experience. This measure allows management to measure the platform traffic and related trends.

(6) The Company defines B2C Marketing Spend Ratio as the total B2C direct marketing expense for the period divided by the total B2C revenues. This metric allows management to measure the success of marketing costs during a given period. Additionally, this measure allows management to compare across jurisdictions and other sub-sets, plus comparison to peers with tracking overtime as an additional indication of return on marketing investment.

(7) Adjusted EBITDA is a non-GAAP financial measure that is provided as supplemental disclosure which the Company defines as net income (loss) before interest costs, income taxes, depreciation and amortization, share-based compensation expense and related expense, impairments, initial public offering related costs and other items which the Board of Directors considers to be infrequent or unusual in nature. Management uses Adjusted EBITDA to measure its financial performance. Specifically, it uses Adjusted EBITDA (1) as a measure to compare its operating performance from period to period, as it removes the effect of items not directly resulting from core operations and (2) as a means of assessing its core business performance against others in the industry, because it eliminates some of the effects that are generated by differences in capital structure, depreciation, tax effects and unusual and infrequent events. The presentation of Adjusted EBITDA is not intended to be used in isolation or as a substitute for any measure prepared in accordance with GAAP. Adjusted EBITDA, as defined, may not be comparable to similarly titled measures used by other companies in the industry, and Adjusted EBITDA may exclude financial information that some investors may consider important in evaluating the Company’s performance. Adjusted EBITDA, as calculated by the Company, along with a reconciliation to net income (loss), the comparable U.S. GAAP equivalent measure, is included below This presentation uses certain non GAAP financial measures as defined in Securities and Exchange Commission rules. The Company reports financial results in conformity with GAAP, and also communicates with investors using certain non-GAAP financial measures. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to, the comparable GAAP financial measures. These non-GAAP financial measures are intended to supplement the presentation of the Company’s financial results that are prepared in accordance with GAAP.

|

|

|

|

|

|

|

In marking this milestone installation by AGLC, Gaming Arts LLC is proud to team up with Bet Rite Inc., its exclusive Canadian representative and distributor providing full sales and service support in Alberta and across Canada. This slot series will be the first offerings in Alberta and in other Canadian Provinces moving forward.

The Pop'N Pays™ games series includes Pinatas Ole™, Big Top™, & Sweet Spin™ games offering players an unforgettable time with pop up wins, free game opportunities, progressives, and much more.

This exciting new Pop'N Pay™ game series is currently live in six Alberta casinos, including Century Mile Racetrack and Casino, Cowboys Casino, Deerfoot Inn & Casino, Grey Eagle Resort and Casino, River Cree Resort and Casino, and Starlight Casino Edmonton.

The next wave of exciting Gaming Arts game series will include: Da Fa Ba™, Dice Seeker™, and the multi-game, Casino Wizard™. These will also be rolling out later this year in other parts of Canada. To enhance these games further, many of our games are offered with the optional Rocket Rollup™ mystery progressive feature to add yet another level of excitement to the players' experience.

Mike Dreitzer, CEO of Gaming Arts, commented, "Gaming Arts is very appreciative of AGLC's decision to launch our games in Alberta, for the first time anywhere in Canada. This is a true milestone for Gaming Arts and we are humbled by AGLC's show of confidence in our product. We look forward to working with AGLC to earn more floor share across Alberta and all of Canada."

"We are very excited and grateful that AGLC is our first Canadian customer to introduce Gaming Arts slots to the Canadian market. We are confident that slot players in Alberta will enjoy these fun series of games for years to come," said Bet Rite President, Billy MacLellan.

Fellow gaming entrepreneur GLI CEO James Maida hosts the episode, and the two explore the significance of a company’s culture, the importance of diversification, land-to-trust issues, the new Mohegan Sun Casino at Virgin Hotels Las Vegas, the relationship between tribal gaming and Las Vegas, Mohegan’s expansion into the Far East, and Soper’s involvement in green solutions.

A key part of the discussion puts a spotlight on iGaming and the future of land-based gaming. Soper said, “We are all fooling ourselves if we don’t think that online gaming in any form, whether it’s lottery, sports wagering, or casino gaming as we know it, is going to continue to grow, and will, to some degree, cannibalize land-based gaming.”

Watch the episode now exclusively at https://gaminglabs.com/illuminatingconversations.

Soper has been envisioning and creating the future of gaming for more than two decades. His latest role as International President at Mohegan Gaming & Entertainment has him developing major projects in Korea and Japan for the tribe, while he is also operating Sun Gaming & Hospitality, and leading several green energy efforts. In his now-legendary tenure at Mohegan Gaming and Entertainment, he led efforts to grow the organization from a single property company to a multi-property international enterprise.

The Illuminating Conversations web series is yet another way GLI gives the gaming industry critical insights that boost confidence to explore new markets.

Every episode of Season One is available now and includes appearances by Eilers & Krejcik’s Gaming Principal Todd Eilers; Jamaica Betting, Gaming Lottery Commission Executive Director Vitus Evans; Managing Director of Gaming Consultants International Neil Spencer; NIGA Chairman Ernest Stevens, Jr.; Ellen Whittemore, Executive Vice President, General Counsel and Secretary at Wynn Resorts; and inventor and entrepreneur Nolan Bushnell.

Follow GLI on LinkedIn, Twitter, Facebook, and Instagram and be the first to know when new Illuminating Conversations episodes are available.

Cashman Bingo is a new one-of-a-kind family of games launched with the titles Cashman Bingo™ Hong Kong Jackpots and Cashman Bingo™ Babylon Jackpots™.

Cashman Bingo introduces a persistent cash on reels mechanic and unique bingo card matrix. This true persistence mechanic copies symbols from the reel matrix to the bingo card each time a cash value is landed on the reel set, accumulating, and persisting until one or more bingo lines are hit.

To suit the tastes of every player and operator, Cashman Bingo is available on any of three of Aristocrat’s cabinets: Helix XT™, Arc Single™, or MarsX Portrait™.

Cashman Bingo has three entertaining features: “Bingo,” where landed cash symbols get copied to the bingo board. Cash value symbols on bingo board accumulate and persist until one or more bingo lines are hit. “Cashman Antics,” where a randomly appearing Mr. Cashman character increases prize values and awards bingo prizes. “Wheel,” where players are awarded credits or a mini, minor, maxi, major, or grand jackpot.

AGT now expects, subject to audit finalisation, the Profit before Tax for the second half of FY21 (2HFY21), excluding one-off items and currency translations, will be approximately $1.6 million – refer to reconciliation provided below. This compares to the estimated Profit before Tax of approximately $1 million announced on 18 May.

Revenue for 2HFY21 is expected to be around $88 million, compared to $72 million in the first half of FY21, an increase of 22%. AGT’s underlying EBITDA for 2HFY21, excluding any one-off items and currency translations, is expected to be around $14.4 million, compared to the $13.2 million previously advised in May.

Australia revenue contribution was $20 million in 2HFY21, resulting in total revenue for FY21 of $39 million, an increase of 39% over the $28 million in the Prior Corresponding Period (PCP) in FY20. Further extended lockdowns across New South Wales and other states within Australia have created an element of uncertainty and risk associated with the timing of when operations across domestic markets will resume.

Given these potential risks, it was considered prudent to embed additional risks in our forecast cashflows when assessing asset values in the Australian and Other (comprising of Rest of World) and Latin America Cash Generating Units (CGU’s). These additional risks may not eventuate, however considering the detrimental impact the Delta variant of COVID-19 is having on society and the consequential restrictions governments are imposing on our customers, it was considered prudent to further risk adjust the forecast cashflows for these CGU’s. As a result, AGT will record an additional non-cash impairment charge in 2HFY21 of $10.3 million against the value of these assets in the FY21 audited results.

The key market of North America has continued to perform strongly in the period with total revenue in FY21 of $88 million, an increase of 22% on the $72 million in the PCP. Additional opportunities are being pursued for AGT’s leading Historical Horse Racing (HHR) products in new jurisdictions following the passing of new legislation.

In addition, a cash sale to Kentucky Downs of 400 HHR units previously operating under participation was recently completed in July 2021. The sale provides for on-going revenue connection fees continuing into FY22. The blended Average Selling Price on this sale was above our average for the region and represented a mixture of hardware configurations including a portion of the newly released A-Star curve cabinets.

AGT further advises that strong cash flows in the second half, along with the effective management of operational expenses, resulted in cash held as at the reporting date of $42 million, an increase of 56% over the PCP. The cash balance excludes any contribution from the previously announced exclusive agreement with GAN Limited, where an initial USD5.0 million was received in early July 2021.

AGT expects to release FY21 full year audited results after close on Thursday 26 August 2021.

This announcement was authorised for lodgement by the Board of Directors.

Full release: https://www.agtslots.com/assets/ASX-Release---Draft-FY21-Financial-Results_Final-.pdf.

Caesars online players now have the chance to play Ainsworth titles that have been proven performers in both land-based and online casinos. Titles available include the popular QuickSpin brand of wheel games and long-time player favorite High Denomination titles.

Additional games will be regularly added to the sites, ensuring players always have access to the hottest games and innovative play styles.

“We’re honored to be partnering with a prestigious operator like Caesars,” said Ainsworth General Manager – Online Jason Lim. “This launch furthers our presence in the New Jersey market, and we’re thrilled to be live with our latest games on the Caesars sites. We are confident the tremendous math models and fun play mechanics will be successful and provide an entertaining experience for Caesars players.”

The registration means that, effective immediately, GLI is authorized to test and certify iGaming components such as games, random number generator (RNGs) platforms/RGS, and cybersecurity, GLI’s services will help to ensure an efficient and timely commencement of operations in the regulated market.

The AGCO and the province will leverage the benefits of GLI’s 30+ years of international experience in iGaming testing, certification, and consultation. Today, GLI is the only lab working with all existing and emerging jurisdictions worldwide, giving GLI unparalleled expertise and insight to help AGCO, AGCO-registered operators, and/or gaming-related suppliers successfully navigate the exciting opportunities in Ontario for iGaming.

In addition to Ontario, GLI has helped all other Canadian provinces currently online with their technical standards and/or mission-critical online gaming testing deployments to date, including the Province of Alberta’s most recent online portal’s launch.

“It is extremely exciting to see the future of the iGaming landscape emerge in Ontario. GLI is proud to be a part of it and honored to have been registered as an authorized test lab by the AGCO,” said GLI CEO James Maida. “We’re always preparing for what’s next- land-based, digital, or both, with experts on the ground around the world. As the pioneer in iGaming and sportsbook testing and certification, we know we will have much to offer, and our global professionals are ready to help in ways no one else can.”

In addition to formal testing and certification work on behalf of the AGCO, GLI is ready to provide other valuable assistance to interested operators and suppliers, such as pre-certification testing, jurisdictional consultation, and regulatory advisory support to help them clearly understand the AGCO Registrar’s Standards for Internet Gaming. GLI also provides a full suite of critical integrated services including GAP Analyses and Transfers of Approval, educational services for iGaming or sports betting compliance, workshops, and many other forms of emerging market support and consultancy.

“Beyond wanting the AGCO and province of Ontario to greatly benefit, we also want operators and suppliers to be commercially successful, all while maintaining the highest levels of integrity in compliance. Our technical and regulatory compliance teams are ready to test, consult and advise on best practices to achieve that,” said Salim L. Adatia, Vice President of Client Services for North America.

To learn more about GLI’s tailored support in all areas of compliance, visit gaminglabs.com/services.

LAS VEGAS, August 5, 2021 - AGS (NYSE: AGS) ("AGS", "us", "we" or the "Company") today reported operating results for its second quarter ended June 30, 2021.

Second Quarter 2021 Highlights:

• Net Loss Improved to $3.9 Million Compared to $7.8 Million in Q1 2021

• Adjusted EBITDA Totaled $32.1 Million, Up More than 20% Over Q1 2021

• Domestic EGM RPD and Domestic Gaming Operations Revenue Established New Company Records

• Orion Starwall Footprint Grew to over 520 Games at Quarter End

• Table Products Adjusted EBITDA Reached a New Quarterly Record of $1.4 Million

• Interactive Real Money Gaming Revenue More than Doubled to a Record $2.2 Million

• Generated Over $14 Million of Free Cash Flow YTD; Nearly $120 Million of Available Liquidity as of June 30, 2021

• Reduced Net Leverage to 5.0x as of June 30, 2021 from 7.5x at December 31, 2020

AGS President and Chief Executive Officer David Lopez said, "We were able to leverage our over 15,000 unit domestic EGM installed base, our growing premium game footprint, and the revenue strength witnessed throughout the domestic gaming market to establish new Company records in both domestic EGM revenue per day ("RPD") and domestic EGM gaming operations revenue in the second quarter. Looking ahead, our improved execution and accelerating product momentum across all three of our business segments position us to deliver additional growth and share taking in the coming quarters."

Kimo Akiona, AGS' Chief Financial Officer, added, "The continuous improvement being achieved as a result of our enhanced game content development execution, upgraded product management capabilities, and refined capital deployment processes, sets us on a path to deliver more consistent financial performance, improving our capital returns and leverage profile, and, most importantly, strengthening shareholder value over time."

The complete quarterly report and presentation are at http://investors.playags.com/financial-information/quarterly-results/default.aspx.

Konami Casino Management System to Support Everi's Cashless Funding and Payment Solution

LAS VEGAS, Aug. 5, 2021 /PRNewswire/ -- Konami Gaming, Inc. and Everi Holdings Inc. (NYSE: EVRI) today announced a partnership to integrate SYNKROS® with Everi's digital CashClub Wallet®. The integration of Konami's award-winning casino management system (CMS) with CashClub Wallet® merges Konami's reputation for high system reliability with Everi's industry leading solutions in cashless payments.

Through this partnership, Konami will offer Everi's flexible, cost-effective, funding and payment solution to operators that utilize Konami's advanced casino management system. SYNKROS empowers operators to capture and compile data through all connected areas of the property — gaming and non-gaming — to generate a 360-degree patron view. This includes marketing, slots, tables, analytics, cage, credit, vault and other interfaced resort amenities.

As one of the industry's leading player tracking systems, SYNKROS is best known for its reliability, marketing tools, and robust data. SYNKROS reaches a wide range of property types — everything from large destination properties to cruise ships, to local casino stops, and entire multi-property portfolios.

"SYNKROS is designed to empower casinos to grow and leverage the latest technology available, through its robust, dependable, and scalable architecture," said Tom Jingoli, Konami Gaming, Inc. Executive Vice President & Chief Operating Officer. "This integration with Everi's cashless solution offers a highly dependable, hassle-free cashless experience for both player and operator."

Working in conjunction with Konami's Money Klip™ — which delivers seamless cashless play at slots and tables — Everi's CashClub Wallet is an omni channel digital wallet that enables casino operators to offer cashless and contactless funding and withdrawals in and out of Money Klip on the gaming floor as well as at other resort amenities. CashClub Wallet empowers casino operators to successfully deliver on all aspects of the emerging mobile ecosystem, including funding at the gaming device, payments at point of sale, or funding online sports betting, iGaming or social gaming — a true cashless experience all while preserving existing options, channels, preferences, and features valued by customer segments.

"The partnership with Konami gives us the opportunity to support the SYNKROS CMS solution with our industry-leading CashClub wallet technology," said Darren Simmons, Executive Vice President and FinTech Business Leader for Everi. "We enhance the player experience by bringing customer-centric features to loyalty, payments, and cage and cash operations. For operators, this partnership creates measurable efficiencies while extending engagement between casinos and their patrons across the gaming environment."

About Everi

Everi's mission is to lead the gaming industry through the power of people, imagination, and technology. Focused on player engagement and assisting our casino customers to operate more efficiently, the Company develops entertaining game content and gaming machines, gaming systems, and services for land-based and iGaming operators. The Company is also the preeminent provider of trusted financial technology solutions that power the casino floor while improving operational efficiencies and fulfilling regulatory compliance requirements, including products and services that facilitate convenient and secure cash and cashless financial transactions, self-service player loyalty tools and applications, and regulatory and intelligence software. For more information, please visit www.everi.com, which is updated regularly with financial and other information about the Company.

About Konami Gaming, Inc.

Konami Gaming, Inc. is a Las Vegas-based subsidiary of KONAMI HOLDINGS CORPORATION (TSE: 9766). The company is a leading designer and manufacturer of slot machines and casino management systems for the global gaming market. For more information about Konami Gaming, Inc. or the SYNKROS gaming enterprise management system, please visit www.konamigaming.com.

Broad-based Strength in Games and FinTech Segment Operating Performance

Provides Full Year 2021 Guidance, including Net Income of $87 Million to $95 Million and

Adjusted EBITDA of $332 Million to $342 Million

Las Vegas – August 4, 2021 - Everi Holdings Inc. (NYSE: EVRI) (“Everi” or the “Company”), a premier

provider of land-based and digital casino gaming content and products, financial technology, and loyaltysolutions, today reported record financial results for the second quarter ended June 30, 2021. The 2021second quarter revenue, net income, Adjusted EBITDA and Free Cash Flow are all slightly above therespective ranges the Company provided on June 21, 2021. The results are a quarterly sequential improvement from the 2021 first quarter, reflecting continued strength in casino patron demand, while stillreflecting an ongoing, but reduced, impact of the COVID-19 pandemic.

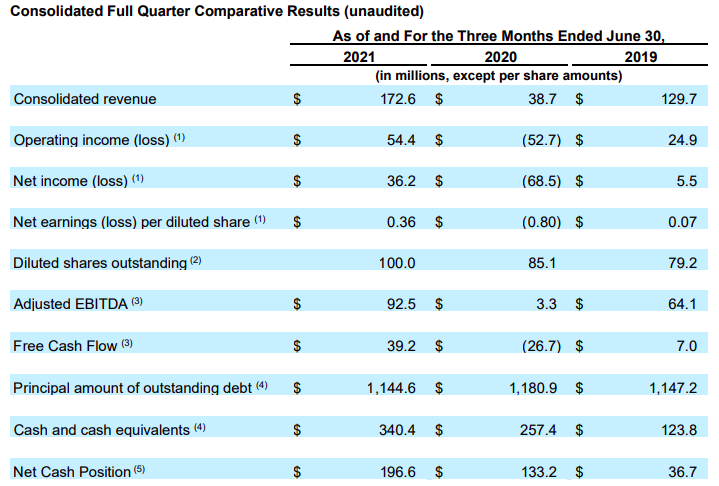

Second Quarter 2021 Financial Highlights Compared to the Second Quarter 2019

Because second quarter 2020 financial results were severely impacted by casino closures related to the COVID-19 pandemic, the Company believes it is more meaningful to compare 2021 second quarter results to those of the 2019 second quarter. Financial results for the 2021, 2020 and 2019 second quarter periods are presented in the Consolidated, Games and Financial Technology Solutions highlight tables below.

• Revenues rose 33% to a quarterly record $172.6 million, compared to $129.7 million in the

2019 second quarter.

• Net income improved 560% to a quarterly record $36.2 million, or $0.36 per diluted share,

compared to $5.5 million, or $0.07 per diluted share, in the 2019 second quarter.

• Adjusted EBITDA, a non-GAAP financial measure, increased 44% to a quarterly record $92.5

million, compared to $64.1 million in the 2019 second quarter.

• Free Cash Flow, a non-GAAP financial measure, increased 462% to $39.2 million, compared

to $7.0 million in the 2019 second quarter.

• Revenue, net income, Adjusted EBITDA and Free Cash Flow are all slightly above the

respective ranges the Company provided on June 21, 2021.

• Subsequent to quarter-end, completed a successful refinancing that reduced total debt to

$1.0 billion, decreased cash interest costs and extended maturities.

Michael Rumbolz, Chief Executive Officer of Everi, said, “The record 2021 second quarter results reflect

the substantial benefit of our execution of our ongoing growth initiatives, as well as improvement in industry trends. The strong momentum to-date this year in revenues, earnings and cash flow is being driven by consistent improvements in our Games and FinTech segment operating performance, demonstrating yet again the substantial demand that exists for our high-value products.

"A key highlight of our significant growth compared to pre-pandemic periods is the strength of our recurring revenue streams, which comprise an increased percentage of our overall business mix. This revenue is a significant contributor to our growing Free Cash Flow, which in turn has allowed us to dramatically lower our net leverage,” added Rumbolz. “Accordingly, we are favorably positioned to prudently invest in both internal product innovation and complementary, high-return, accretive acquisitions that will support our future growth.”

Mark Labay, Chief Financial Officer of Everi, said, “Our improved performance positioned us to obtain a

strong response from the capital markets for our recent debt refinancing, including credit rating agency upgrades of all our newly issued debt instruments. This resulted in lower borrowing rates and extended debt maturities. Upon completion of this successful refinancing, at current interest rates our annualized cash interest costs will now be approximately $23 million less than at June 30, 2021. We expect our lower annual interest will contribute to the sustainability and further growth of our Free Cash Flow.”

(1) Operating loss, net loss, and net loss per diluted share for the three months ended June 30, 2020, included $14.8 million of pre-tax charges, including $11.0 million of business reorganization costs, $2.7 million of employee severance costs, $0.6 million non-recurring professional fees, and $0.5 million in other one-time charges. Operating income, net income and net earnings per diluted share for the three months ended June 30, 2019 included approximately $0.8 million for certain non-recurring professional fees and related costs and expenses associated with the acquisition of certain player loyalty assets and a non-cash charge of $0.8 million for the write-off of inventory related to certain legacy cabinets.

(2) In December 2019, the Company completed a public offering of 11.5 million shares of common stock. Weighted average basic shares outstanding were 88.7 million, 85.1 million, and 71.5 million shares for the periods ended June 30, 2021, 2020, and 2019, respectively.

(3) For a reconciliation of net income (loss) to Adjusted EBITDA and Free Cash Flow, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP Measures provided at the end of this release.

(4) Subsequent to quarter-end, the Company reduced its total outstanding debt to $1.0 billion through the successful issuance of $400 million of 5.000% senior unsecured notes due 2029 and $600 million of senior secured term loan at a rate of LIBOR plus 250 basis points with a LIBOR floor of 50 basis points due 2028, along with a $125 million revolving credit facility that is currently undrawn. In completing the transactions on August 3, 2021, the Company used cash on hand to pay the transaction fees and expenses and reduce the total debt by $144.6 million from the June 30, 2021 reported amount.

(5) For a reconciliation of Net Cash Position to Cash and Cash Equivalents, see the Unaudited Reconciliation of Cash and Cash Equivalents to Net Cash Position and Net Cash Available at the end of this release.

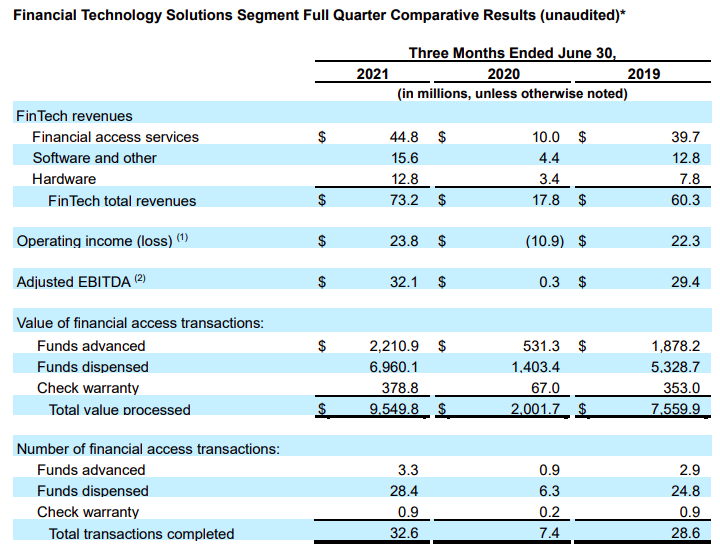

Second Quarter 2021 Results Overview

Results for the three-month period ended June 30, 2021 reflect the continued, albeit lesser, impact of the COVID-19 pandemic. Results for the 2020 second quarter reflect the impact of the COVID-19 pandemic and results for the 2019 second quarter were unimpacted by the pandemic.

Randy Taylor, Everi’s Chief Operating Officer, said, “Our record quarterly revenue was up 33% over the pre-COVID 2019 second quarter, primarily driven by the strength in our recurring revenue operations in both our Games and FinTech segments. Our Games segment momentum reflects the continued growth in our installed base of gaming operations units, particularly increased placements of our higher-earning premium units that drove the increase in daily win per unit. In addition, slot machine sales increased by 49% sequentially from the 2021 first quarter, reflecting what we believe is another quarter of higher ship share of replacement units. Second quarter unit sales also benefited from a larger share of shipments to new casino openings and expansions than we have historically achieved together with a greater number of new casino openings and expansions than typically experienced in a quarter.

“Our FinTech segment continues to benefit from our comprehensive, integrated financial access services and RegTech software solutions, as well as our newer loyalty products such as our updated and upgraded self-service loyalty kiosks. Our strong FinTech industry position enables Everi to benefit from the widespread increase in casino player activity, which drove mid-teens percentage growth in the number of financial access transactions we processed as compared to 2019 second quarter volumes; a rate that was significantly above our historical rate of growth.

“The operating performance of our two segments, together with a continued focus on operating expenses, led to net income of $36.2 million, or $0.36 per diluted share, record quarterly Adjusted EBITDA of $92.5 million, up more than 40% over the comparable 2019 period, and Free Cash Flow generation of $39.2 million.

“Additionally, we continue to see a high level of interest by casino operators in our cashless digital wallet solution and our iGaming slot content. These are two important growth initiatives in which we’ve invested over a number of years given our expectation that they can both be additive to our core business momentum in the near- and long-term.”

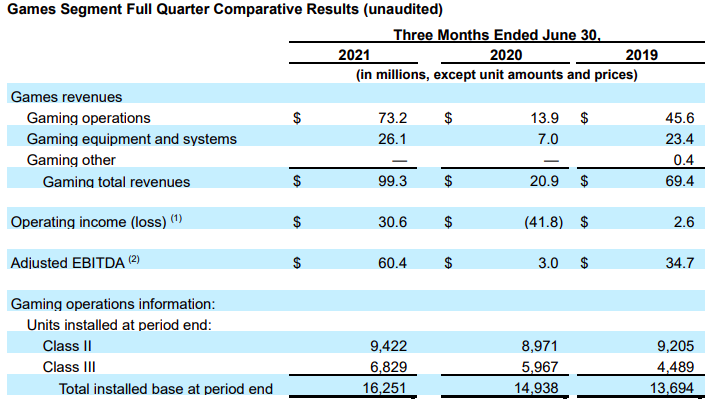

(1) Operating loss for the three months ended June 30, 2020, included $11.3 million of pre-tax charges, including $9.2 million of business reorganization costs, $1.6 million of employee severance costs and $0.5 million of other one-time charges. Operating income for the three months ended June 30, 2019 included approximately $0.3 million for certain nonrecurring professional fees and related costs and a non-cash charge of $0.8 million for the write-off of inventory related to certain legacy cabinets.

(2) For a reconciliation of net income (loss) to Adjusted EBITDA, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP measures provided at the end of this release.

(3) Daily win per unit reflects the total of all units installed at casinos, inclusive of closed casinos and inactive units, where such units would have recorded no revenue and excludes the impact of the direct costs associated with the Company’s wide-area progressive jackpot expense.

(4) The ending and average installed base for all three periods includes all units, whether or not casinos were open and whether or not the games were active.

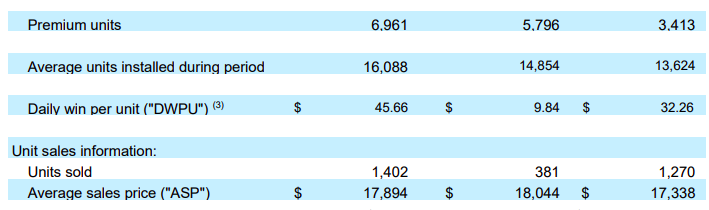

2021 Second Quarter Games Segment Highlights

Games segment revenues increased to a quarterly record $99.3 million compared to $20.9 million in the 2020 second quarter and was up 43% over the $69.4 million in the 2019 second quarter. This reflects strong gaming operations performance as well as higher shipments of gaming machines.

Operating income increased to $30.6 million, compared to an operating loss of $41.8 million a year ago and operating income of $2.6 million in the second quarter of 2019. The increase in the 2021 second quarter operating income over the prior-year periods reflects the benefit of higher revenues, a greater 5 proportion of higher-margin gaming operations revenue in the overall mix, the Company’s cost containment efforts, and lower amortization. Adjusted EBITDA increased to a quarterly record $60.4 million, from $3.0 million and $34.7 million in the second quarter of 2020 and 2019, respectively.

Gaming operations revenue grew to a quarterly record $73.2 million, compared to $13.9 million and $45.6 million in the second quarter of 2020 and 2019, respectively.

• Reflecting the player popularity of the latest games and the growth in higher-earning premium unit placements, Daily Win per Unit (“DWPU”) rose to a quarterly record $45.66 in the second quarter of 2021, compared to $9.84 and $32.26 in the second quarter of 2020 and 2019, respectively.

• The installed base as of June 30, 2021 increased by 9%, or 1,313 units, year over year and by 302 units on a quarterly sequential basis to a record 16,251 units. • The premium portion of the installed base increased by 20%, or 1,165 units, year over year and by 264 units on a quarterly sequential basis to 6,961 units. Growth was driven primarily by incremental placements of the strong-performing The Vault™ game theme and premium mechanical reel games, as well as the continued solid performance of other themes including Smokin' Hot Stuff Wicked Wheel® and Shark Week®. Premium units represented 43% of the total installed base at quarter-end compared to 39% a year ago and 25% as of June 30, 2019. Wide-area progressive (“WAP”) units, a subcategory of premium units, grew by 114 units year over year to 1,082 units as of June 30, 2021, partly reflecting the launch of the new Monsterverse™ game on the Empire DCX® cabinet and the installation of the first WAP into commercial casinos in Nevada and New Jersey.

• Digital revenue more than doubled to $3.6 million in the second quarter of 2021 compared to $1.5 million a year ago and increased 50% on a quarterly sequential basis, partially reflecting a full quarter of revenue from Michigan. Digital revenue growth also reflects increased B2B revenue from the expanded base of iGaming operator sites featuring the Company’s games – including in West Virginia, British Columbia and Manitoba that went live during the quarter – along with a growing library of available slot content.

• Revenues from the New York Lottery system business were $6.3 million in the second quarter of 2021, compared to $4.9 million in the second quarter 2019. There was no revenue in the second quarter of 2020 due to the impact of the COVID-19 pandemic.

Gaming equipment and systems revenues generated from the sale of gaming units and other related parts and equipment totaled $26.1 million in the second quarter of 2021, compared to $7.0 million and $23.4 million in the second quarter of 2020 and 2019, respectively.

• The Company sold 1,402 units, including several hundred units for new casino openings and expansions, at an average selling price (“ASP”) of $17,894 in the second quarter of 2021. This is an increase compared with 381 units at an ASP of $18,044 in the second quarter of 2020 and 1,270 units at an ASP of $17,338 in the second quarter of 2019.

* Rounding may cause variances.

(1) Operating loss for the three-month period ended June 30, 2020, included $3.5 million of pre-tax charges, including $1.8 million of business reorganization costs, $1.1 million of employee severance costs and $0.6 million of non-recurring professional fees. Operating income for the three months ended June 30, 2019 included the impact of approximately $0.5 million for certain non-recurring professional fees and related costs and certain expenses associated with the acquisition of certain player loyalty assets.

(2) For a reconciliation of net income (loss) to Adjusted EBITDA, see the Unaudited Reconciliation of Selected Financial GAAP to Non-GAAP Measures provided at the end of this release.