GALAXY GAMING REPORTS Q2 2022 FINANCIAL RESULTS

LAS VEGAS, Aug. 15, 2022 (GLOBE NEWSWIRE) -- Galaxy Gaming, Inc. (OTCQB: GLXZ), a developer and distributor of casino table games and enhanced systems for land-based casinos and iGaming content, announced today its financial results for the quarter and six months June 30, 2022.

Financial Highlights

Q2 2022 vs. Q2 2021

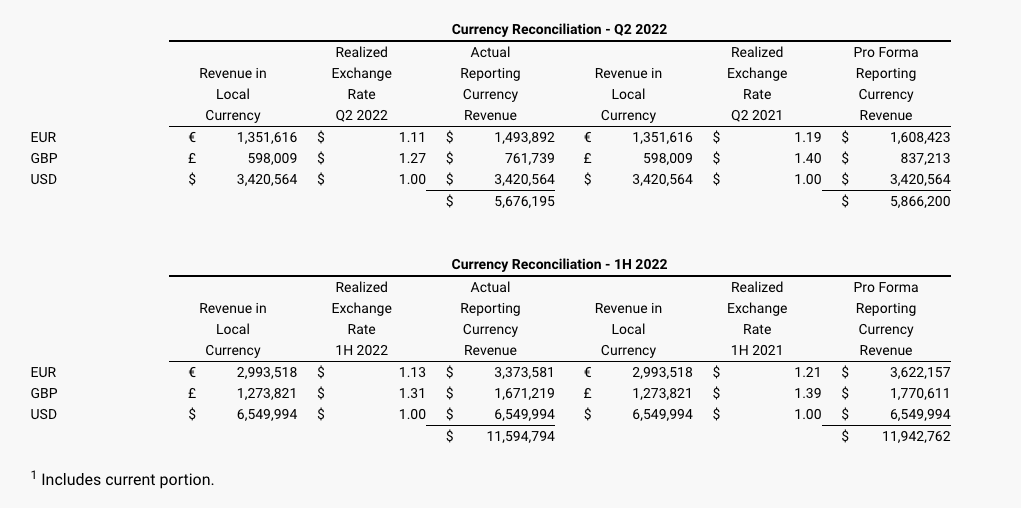

Revenue increased 20% to $5,676K

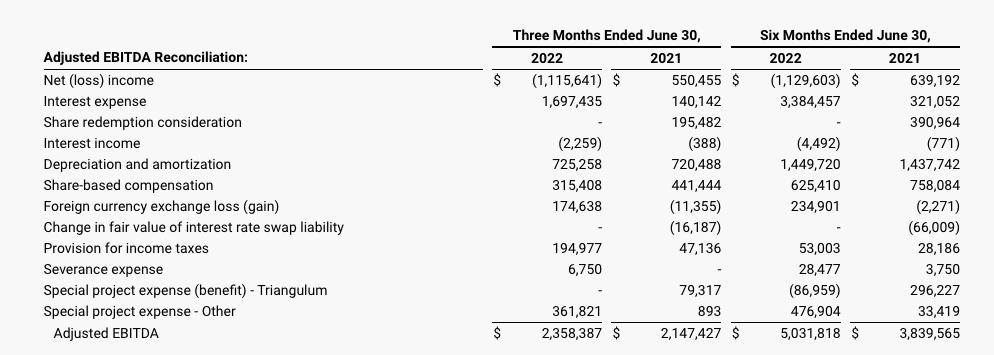

Adjusted EBITDA increased 10% to $2,358K

Net loss of $(1,116)K vs. net income of 550K

1H 2022 vs. 1H 2021

Revenue increased 28% to $11,595K

Adjusted EBITDA increased 31% to $5,032K

Net loss of $(1,130)K vs. net income of 639K

Balance Sheet Changes (vs. December 31, 2021)

Cash increased 7% to $17,250K

Total long-term debt1 (gross) decreased to $59,868K from $60,500K

Stockholders’ deficit increased to $(18,0297)K from $(17,286)K

Executive Comments

“The second quarter of 2022 was a perfect storm of rates - foreign exchange rates, inflation rates and interest rates,” said Harry Hagerty, Galaxy’s CFO. “The appreciation of the US Dollar against the Euro and the British Pound cost us $190K in revenue in the quarter (as compared to what we would have realized using the rates that applied in Q2 2021). We have seen very little benefit from the new rates on the expense side, as most of our expenses are denominated in dollars. The increase in inflation has affected us as we have seen significant increases in travel expenses and are having to offer increased salaries and wages to hire new employees and to retain existing ones. Finally, the floating interest rate on which our long-term debt is based has risen by 116 basis points from January to July.”

“The external conditions that Harry described masked what was an excellent quarter and first half,” said Todd Cravens, President and CEO. “On a constant currency basis, revenue increased by 24% in the quarter and the 32% in the first half as compared to the same periods in 2021. And we have some exciting things happening in the second half. In Galaxy Core (our land-based business), one of our high-end UK customers will launch the first three-meter progressive, with a top side bet of £100 – the first in the world. We started installations of our new Triton 1.0 progressive platform in the US in the third quarter and will demonstrate Triton 2.0 at G2E in October. Galaxy Digital (our online business) continues to do well. With our partner SPIN Games, we launched the first online 21+3? Progressive, and we will release our own online roulette and baccarat titles in the second half of 2022 to complement our strong position in blackjack side bets. I’m excited about the fundamentals of our business and am confident we’ll manage through the wider macroeconomic issues. We focus on the things we can control.”

“Despite the headwinds, our liquidity and balance sheet remain in good shape,” continued Hagerty. “We had more than $17 million in cash at quarter-end and were comfortably in compliance with the net leverage covenant in the Fortress Credit Agreement.

“Unfortunately, current exchange rates are even lower now than they were in Q2,” Hagerty added. “On the assumption that these rates will be with us for the rest of the year and that the cost and wage pressures will also continue, we are lowering our guidance for the year. We now forecast revenue in a range of $22.5-$23.5 million and Adjusted EBITDA in a range of $10-11 million. This forecast assumes no new lockdowns from COVID-19, no impact to our business from the war in Ukraine, and no economic recession.”