Aristocrat Accelerates Strategy and Delivers Strong Growth in FY21

Aristocrat accelerates strategy and delivers strong growth in FY21

Sydney, 18 November 2021

KEY HIGHLIGHTS

• Established growth strategy and sustained investment in outstanding product, people and

capability delivered greater diversification, resilience and profitable growth in FY21

• Strong operating cash flow and a robust balance sheet provides flexibility and optionality to

accelerate growth plans through organic investments and strategic M&A in FY22

• 81% growth in normalised NPATA to $865 million in FY21 (up 102% in constant currency)

delivers performance close to 2019 levels with a stronger, more diverse and resilient

business

• Strong recovery and performance in Gaming driven by market-leading products and portfolio,

and above-category growth in Pixel United1, Aristocrat’s mobile games publishing business

(formerly Digital) driven by strong portfolio performance and player engagement

Aristocrat Leisure Limited (ASX: ALL) today announced its financial results for the year ended

30 September 2021, further to the Trading Update released on 18 October 2021.

Normalised profit after tax and before amortisation of acquired intangibles (NPATA) of $864.7 million represents an increase of 81% in reported terms, and 102% in constant currency,

compared to the prior corresponding period (PCP), reflecting strong product and portfolio performance, and profitable growth across both Aristocrat Gaming and the Pixel United1

businesses.

The Group maintained its market-leading investment in game design, development and

technology in the period, allowing it to grow share in core segments and in adjacencies with its

diversified portfolios of top-performing, world-class games and products.

Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) of $1,542.9 million is 43%

higher on a reported basis and 58% higher on a constant currency basis compared to the PCP.

Aristocrat Chief Executive Officer and Managing Director, Trevor Croker, said “The results and

momentum we’ve delivered this year demonstrates the successful execution of our growth strategy.

“We continued to take share and deliver above-category organic growth over the year through

sustained investment in outstanding product, people and capability, and further strengthening our business fundamentals.

“Our progress is reflected in the share growth and margin expansion achieved across key segments during the year, with industry-leading games and products and further diversification

across our Aristocrat Gaming and Pixel United1 portfolios.

“Aristocrat’s recommended offer to acquire Playtech plc, announced after period end, is another demonstration of our appetite to accelerate the implementation of our strategy thr ough accretive M&A, in particular where it can deliver new capabilities and access to significant growth opportunities. We are focused on achieving necessary approvals, and continue to expect the

acquisition to complete in the second quarter of calendar year 2022.

“We are also making important progress in our sustainability efforts, with the launch of product

innovations in responsible gameplay this year, together with additional corporate governance,

culture and diversity initiatives, reflecting our priorities. Furthermore, we have committed to

adopting a science-based greenhouse gas emissions reduction target, consistent with the Paris

Agreement, by the end of 2023. We look forward to sharing full details with the launch of our

FY21 Sustainability Report later this month.

“Aristocrat enters fiscal 2022 with excellent operational momentum, business resilience, and an appetite to continue to invest organically and through M&A to accelerate our growth strategy,”

Mr Croker concluded.

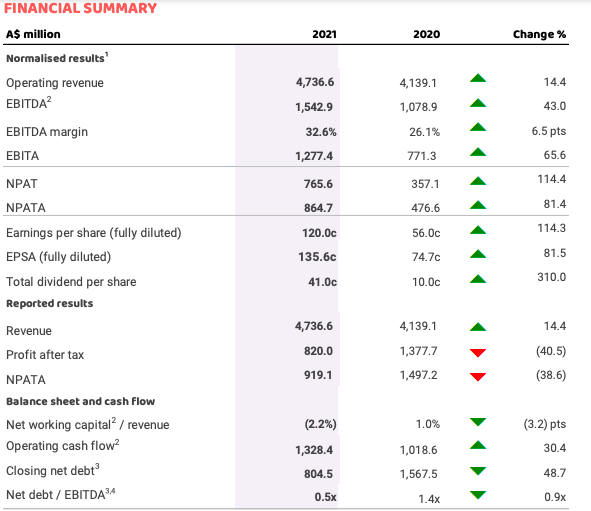

NOTES TO TABLE:

(1) Normalised results are statutory profit (before and after tax), excluding the impact of certain significant items detailed

in the Operating & Financial Review.

(2) During the year, the Group revised its accounting policy in relation to configuration and customisation costs incurred in

implementing software-as-a-service (SaaS) arrangements with cloud providers. The change has been applied retrospectively and impacted the comparatives of the Group. Refer to note 6-7 of the Financial Statements.

(3) Net debt excludes lease liabilities recognised under AASB 16 from 1 October 2019.

(4) Consolidated EBITDA for the Group as defined in Aristocrat’s Syndicated Facility Agreement (also referred to as Bank EBITDA).

Group revenue increased to $4.7 billion, representing a 14.4% increase in reported terms and 24.8% increase in constant currency compared to the PCP, driven by growth across North

American Gaming Operations, North American and ANZ Outright Sales and Pixel United’s (formerly Digital) mobile games segment.

Operating cash flow remained strong at $1,328.4 million for the period, up 30.4% compared to the PCP reflecting strong business performance and its underlying cash flow generation capability. The Group’s balance sheet remained robust, with gearing (net debt to EBITDA) further reduced to 0.5x from 1.4x, and in excess of $2.7 billion of liquidity available as at 30 September 2021.

Reported results for the prior period reflected the significant item recognition of a deferred tax

asset of approximately $1 billion, in line with the Group structure changes disclosed in the FY20

Annual Report.

The Directors have authorised a final fully franked dividend of 26.0cps (A$174.0 million) for period ended 30 September 2021, taking the full year fully franked dividend to 41.0cps (A$269.6 million). The record and payment dates for the final dividend are 2 December 2021 and 17 December 2021, respectively.

OPERATIONAL HIGHLIGHTS

Aristocrat’s portfolio of scaled, world-class assets continued to grow and diversify over the 12 months to 30 September 2021. 80% of revenue was derived from recurring sources in the period, enhancing the business’ resilience.

The Group’s growth continues to be underpinned by sustained investment in game design,

development and technology, with $527.6 million investment in Design & Development (D&D) in

the period, representing 11.1% of Group revenue. This is in line with the Group’s growth strategy,

further strengthening its strategic differentiators and positioning the business to benefit from a

rebound in consumer confidence in key markets, and elevated demand for mobile gaming

entertainment options.

Highlights for the period included:

Aristocrat Gaming:

• Industry recognition for its high-performing game portfolio, including 17 of the top 25

Premium Leased games2 and winning three major awards including Land-Based Industry

Supplier of the Year at the G2E 2021 Global Gaming Awards3

• Share growth along with outstanding average fee per day (FPD) achieved across North

American Class II and Class III premium installed bases, which grew to 54,032 units with

almost all machines switched on in venues that were open at 30 September 2021.

• Outright Sales momentum and growth in adjacent segments in North America, and marketleading ship share maintained in ANZ.

• Results were supported by stronger than expected consumer sentiment and economic

conditions in the United States and ANZ region.

Pixel United1:

• Cementing its position as a Top 5 mobile games publisher in tier-1 western markets4, and

published 7 of the top 100 mobile games in the US across multiple genres at 30 September

2021.

• Growing share in mobile games over the period to being the clear #1 in the Social Slots

segment (#2 in the broader Social Casino genre), #1 in the Squad RPG (Role-Playing Games)

segment and #2 in the Casual Merge segment, according to industry data (Sensor Tower).

• Continued to build portfolio diversity with the continued profitable growth of RAID: Shadow

LegendsTM, successful scaling of EverMergeTM in the Casual Merge genre and worldwide

launch of the new multiplayer action game Mech Arena: Robot ShowdownTM in the period.

• Successful delivery of Live Ops, new features and slot content and efficient User Acquisition

(UA) investment representing 28% of Pixel United1

revenue.

• Three key talent focused acquisitions to grow presence in key high quality lower cost mobile

development hubs.

• A 25% increase delivered in Average Bookings per Daily Active User (ABPDAU) to US$0.74

driven by performance of Social Casino games, improved monetisation of Casual games

and continued scaling of RAID: Shadow LegendsTM.

• Overall demand remained at elevated levels compared to the pre-COVID period.

Outlook

Aristocrat plans for continued growth over the full year to 30 September 2022, assuming no

material change in economic and industry conditions, excluding the impact of the proposed

acquisition and funding of Playtech plc and reflecting the following factors:

• Enhanced market-leading positions in Gaming Operations, measured by the number of

machines and fee per day.

• Sustainable growth in floor share across key Gaming Outright Sales markets globally.

• Further growth in Pixel United1 bookings, with UA spend expected to be within the recent

range of 26% and 29% of overall Pixel United1

revenues, pending timing and success of new

game launches during the year.

• Continued D&D investment to drive sustained, long-term growth, with investment likely to be

modestly above the historic range of 11-12% of revenue; and

• Further investment in core business capability, to facilitate ongoing transformation in our

scale and velocity.

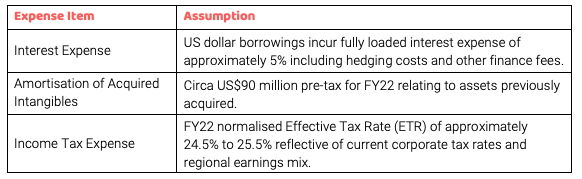

Non-operating items include:

Authorised for lodgement by Kristy Jo, Company Secretary

Further information:

Financial: Rohan Gallagher

General Manager, Investor Relations

Mobile: (61) 421 051 416

rohan.gallagher@aristocrat.com

Media: Natalie Toohey

Chief Corporate Affairs Officer

Mobile: (61) 409 239 459

natalie.toohey@aristocrat.com

________________________

1 Aristocrat’s mobile game publishing business, previously referred to as Aristocrat Digital, was rebranded ‘Pixel United’ in November 2021. References to the business have been updated to Pixel United in this release and the accompanying

FY21 Investor Presentation. The Group’s financial reporting will reference Pixel United from HY22.

2 Average performance for the 12 months to September 2021; Eilers reports.

3 Aristocrat also won Slot of the Year and Land-Based Product of the Year.

4 Source: Sensor Tower; Tier-1 western markets defined as the United States, United Kingdom, Canada, France, Germany,

and Australia.